2024 Atal Pension Yojana application process, contributions, eligibility, benefits, and more at https://www.npscra.nsdl.co.in/scheme-details.php

Atal Pension Yojana

The Indian economy comprises 50% unorganized sectors, which hold thousands of workers (families). The sector has daily wagers, unskilled workers, and casual laborers. The groups tend to live from hand to mouth, meaning they don’t consider saving part of their salaries. The greater impact is felt after the active years of working and retirement age knocks in. Most of the families in the sector lead poor life finding it difficult to get proper medication, basic needs, and education.

The government has developed a unique social saving scheme for all unorganized sector employees to curb retirement disasters. The Atal Pension Yojana (APY) is a unique retirement benefits scheme designed to help all registered members get better retirement services from the government.

The scheme applies to private organization workers who don’t benefit from pension schemes. The Atal Pension Yojana was developed in 2015-2016 to assist in pension benefits for the unorganized working groups. APY scheme contains fixed pension ranging from:

- Rs. 1000

- Rs. 2000

- Rs. 3000

- Rs. 4000

- Rs. 5000

The pension benefits are ranges based on age and contributions. Eligible applicants should have a nominee in death or exceptional circumstances such as fatal accidents, disability, or mental illness. The pension contribution is managed by the Pension Funds Regulatory Authority of India (PFRDA). The government offers a co-contribution of 50% of the total contributions or Rs. 1000 P.A. This only applies to members who had joined the APY scheme from June 2015 to December 2015. The offer goes for five years; however, the eligible member shouldn’t be a member of any other social security scheme.

Eligibility Criteria for Atal Pension Yojana

To avail of the APY scheme benefits, the applicant should fulfill several criteria set by the government. Note the scheme works for people in the unorganized sector.

- The applicant must be an Indian citizen.

- They must be 18 years to 40 years.

- Minimum contributions of 20 years.

- The bank account should be linked with the Aadhaar card.

- Have registered mobile number.

- Applicants in the Swavalamban Yojana will automatically shift to Atal Pension Yojana.

Downloading the APY scheme form

There are three ways to avail of the APY scheme application form.

- Visiting the branch offices for authorized banks.

- Through the respective bank website page.

- Visiting the PFRDA website page.

How to Apply for Atal Pension Yojana

- On the authorized bank website page, open to avail the APY scheme application form.

- The user should select the preferred language, English, Gujarati, Kannada, Marathi, Odia, Tamil, Telugu, and Bangla.

- Fill in the mandatory details on the form, such as active mobile number, Aadhaar card, and more.

- Recheck the information and submit it to the respective bank.

- The system will verify the details and approve if the details are okay.

Atal Pension Yojana form

Addressing details

The applicant needs to address the Branch manager, key in the name, and a branch office.

Banking details

Enter the bank account number, bank name, bank branch on the space provided.

Personal Details

Select the appropriate option for marital status.

Name, date of birth, age, name of spouse.

Mobile number, email address, Aadhaar card.

Your nominee details

For minor nominees, enter the guardian’s name.

Pension information

The EPY scheme has fixed deposit options from Rs. 1000 to Rs. 5000. Enter the amount which you fit best. To ensure steady flow on monthly contributions.

Declaration and authorization

Enter the current date and places on the document. Next, you need to sign or put a thumb impression to verify and declare that you meet all APY criteria. Ensure all the details entered are correct to avoid dismissal from the scheme.

Bank officials (acknowledgment)

The bank will fill the section after verifying and approving all the details.

APY Scheme Investment Plans

The APY scheme funds are invested in various plans to provide reasonable returns.

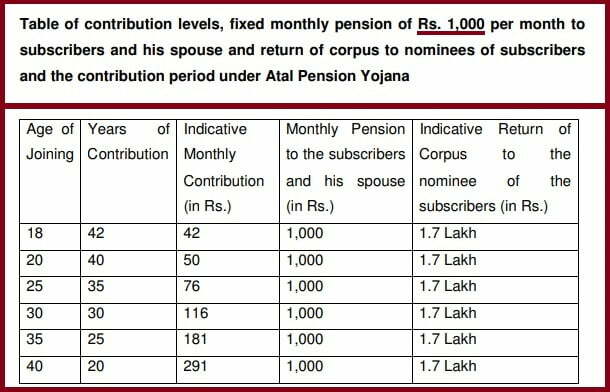

Contributions for APY scheme based on the pension

Monthly pension Rs.1000

Monthly pension of Rs. 2000/-

Monthly pension of Rs. 3000/-

Monthly pension of Rs. 4000/-

Monthly Pension of Rs. 5000/-

APY Withdraw Process

The initial APY withdrawal agreement only allowed participants to withdraw at the age of 60 years. However, there is some modification in the process as follows.

- When you attain 60 years

Once the beneficiary attains 60 years of age, they can visit the bank to apply for the pension.

- Exiting before 60 years

The law allows the applicant to request the funds before the proper age if an exception reason is provided. If the beneficiary dies or gets a terminal illness, the nominee can ask for the funds.

Atal Pension Yojana in Hindi

FAQs

What are the tax benefits of the APY scheme?

The scheme beneficiaries with tax deductions under the tax law section 80 CCD IT Act 1961.

What is the requirement for the APY scheme?

Bank details. The applicant must be 18 years to 40 years. Registered mobile number. Aadhaar card

For more details visit this link https://www.npscra.nsdl.co.in/scheme-details.php