GHMC Property Tax online payment 2025-26: Greater Hyderabad Municipal Corporation (GHMC) property tax payment online 2025-2026 soon & Ghmc property tax search at https://onlinepayments.ghmc.gov.in.

GHMC Property Tax

The majority of the services conducted by the state municipal authorities. Is funded by property tax funds generated by property taxpayers of the particular state. Greater Hyderabad Municipal Corporation Property tax is an excellent source of revenue for state governments in India. The amount helps in funding civil amenities, maintaining and constructing roads, drainage, cleanliness of the state and public parks.

The telangana state government governs all the property tax but delegates the power to municipals’ efficient workflow levels. Each municipality works differently according to the levy, computation and mode of payment.

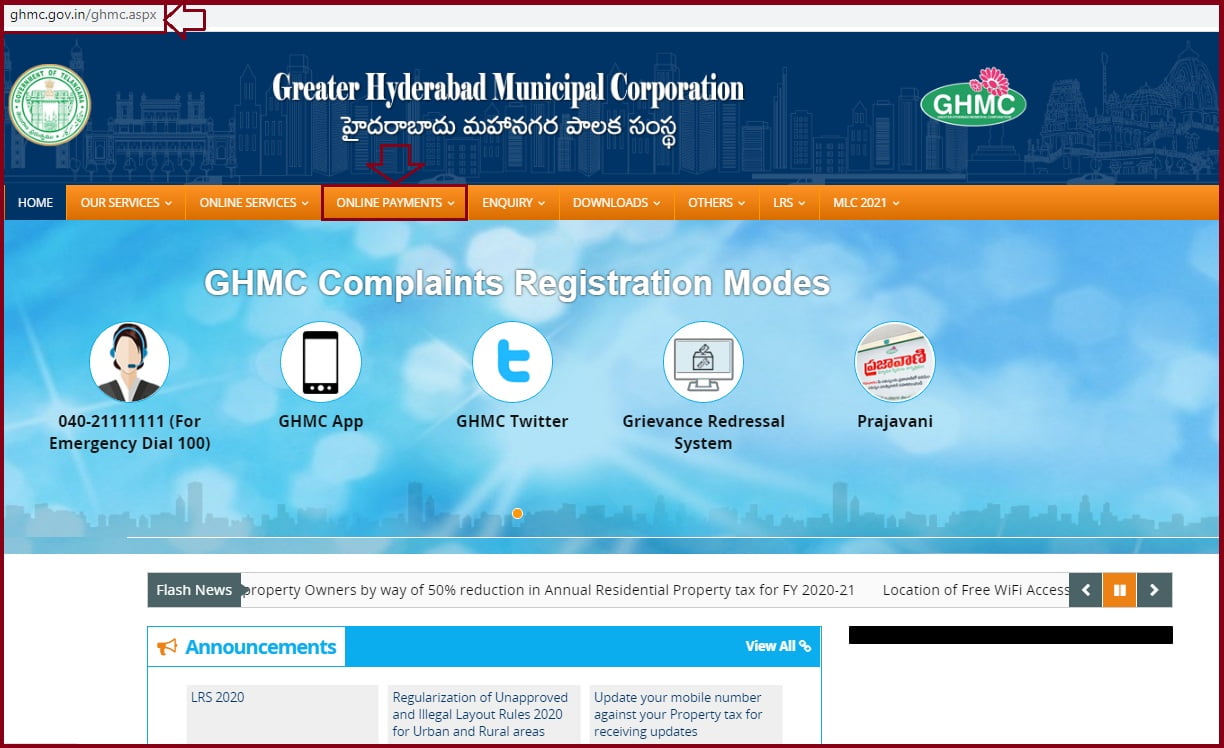

In Hyderabad, the property tax is collected by the greater hyderabad municipal corporation (GHMC). The municipal corporation has issued taxpayers with easy online platforms. For the tax payment process, these ease the hassles of visiting the offices and missing deadlines. The residents can access the portal to check on rates and tax calculation based on their areas.

GHMC Property Tax Online Payment

To make property payment, the user needs to login to the portal and follow the steps below:

- Open the link https://ptghmconlinepayment.cgg.gov.in/ptOnlinePayment.do.

- (or) https://www.ghmc.gov.in/Propertytax.aspx

- On the login page, click the option “payment tax payment” on the menu.

- Next key in your PTI number and click submit button.

- The system will load a new page with arrears, taxable amount, interest on arrears and adjustments.

- Now check all the information to ensure it is correct before making payments.

- Proceed and choose the payment mode from the drop-down list choices (credit card, internet banking or debit card).

Ghmc.gov.in

https://ghmc.gov.in/Propertytax.aspx

| GHMC Property Tax Payment | https://onlinepayments.ghmc.gov.in/ |

| Search Your Property Tax | https://onlinepayments.ghmc.gov.in/PTax/PTSearch_Main |

| Print Receipt GHMC | https://onlinepayments.ghmc.gov.in/PTax/PT_Recipts_Main |

| Trade Licence Payment | https://onlinepayments.ghmc.gov.in/TLTax/TLPayment |

| Search Your Trade License | https://onlinepayments.ghmc.gov.in/TLTax/Search_Your_Trade |

| GHMC Vacant Land Tax Payment | https://onlinepayments.ghmc.gov.in/VLT/ShowVLT_Main |

GHMC Property Tax Calculator

Property taxpayers can calculate their annual tax by getting their total plinth Area and rent in Rs /sq. ft. /month. One can access the information through the link https://www.ghmc.gov.in/propertytax.aspx.

To land to the residential property tax, you need to follow the steps below:

First measure your plinth area (PA) this is the total built-up area. The measurements cover all covered areas including balcony and garage.

Residential Property Tax Computation

- The annual property tax = gross annual rental value (GARV) *(17%-30%) slab rate which is determined by the MRV fixed by GHMC- 10% depreciation + 8% library access.

- GARV = plinth area*monthly rental value in Rs/ sq. ft.*12

GHMC Commercial Property Tax Calculation

The annual property tax =3.5*plinth area in sq. ft.*monthly rental value in Rs/ sq. ft.

Note the monthly rental value / sq. ft. for the commercial properties. Is always set by the GHMC based on the area of taxation zone and the type of construction. The municipal also calculate the value using the type of activity or usage of the building.

The GHMC allows user to register for self-assessment of the property tax. Open the GHMC website page and fill the online form. However, you require the following details:

Owner details

- First and last name

- Operational mobile number

- Email id and circle.

Property details

- The locality/ area name.

- Street/road name.

- The permission number and permission date for the building.

- PIN code, building type and door number.

- Plinth area and floor usage type.

All taxes are paid via online e-Seva counters, citizen services centres, and Hyderabad branches’ state bank. For cheque payment/DDs they should be paid in favour of “commissioner, GHMC” and bill collectors.

The GHMC Due Date for Property Tax Payments

The GHMC also has set penalties for taxpayers who ignore or don’t pay taxes on due dates.

- The bi-annual payment date for the GHMC property tax payment is 31st July and 15th October.

- The amount will gain an interest rate of 2% per month if you don’t pay the tax.

Rebates and penalties from the GHMC

- To award the property taxpayers who pay on time.

- The GHMC has a lucky draw where they give Rs. 20,00,000 to one lucky winner. The winner must pay the tax on time and also enter the draw to participate.

- The GHMC also awards all owners of building with rainwater harvesting facilities. Those who use solar power to generate power. They will receive tax incentives.

- For the late taxpayer, they will receive an interest of 2 % every month.

Who is Exempted From Paying GHMC Property Tax?

There are various structures or people who are exempted from paying property tax in Hyderabad.

The GHMC property taxes all non-agricultural lands, buildings and structures. The taxes vary according to thetype of structure, activity and area. However, there are building which is exempted from property tax.

- All properties owned by military servicemen and ex-servicemen.

- Religious places shouldn’t be taxed.

- The residential building which is occupied by their owners and whose annual value doesn’t exceed Rs. 600.

- Educational institutions which go up to standard X.

- For the vacant premises, a 50% concession is offered as vacancy remission.

FAQ’s

Should I pay property tax if my property/building has been vacant and not occupied by anyone?

The GHMC allows a remission of 50% for all vacant buildings. These will also apply based on the tax inspector field report.

What determines how much property tax I should pay?

Different factors determine the property tax of a particular taxpayer. It can be the market value, location of the property, annual rental value, the municipal authority. Other factors are the Unit area value system and a built-up area of the property.

How often should I pay property tax?

The property tax has set a date and time every year. The taxpayer should pay property tax on an annual basis.

Ghmc dpms

http://dpms.ghmc.telangana.gov.in/bpamsclient/

GHMC Online payment 2025-2026 direct link

https://onlinepayments.ghmc.gov.in/