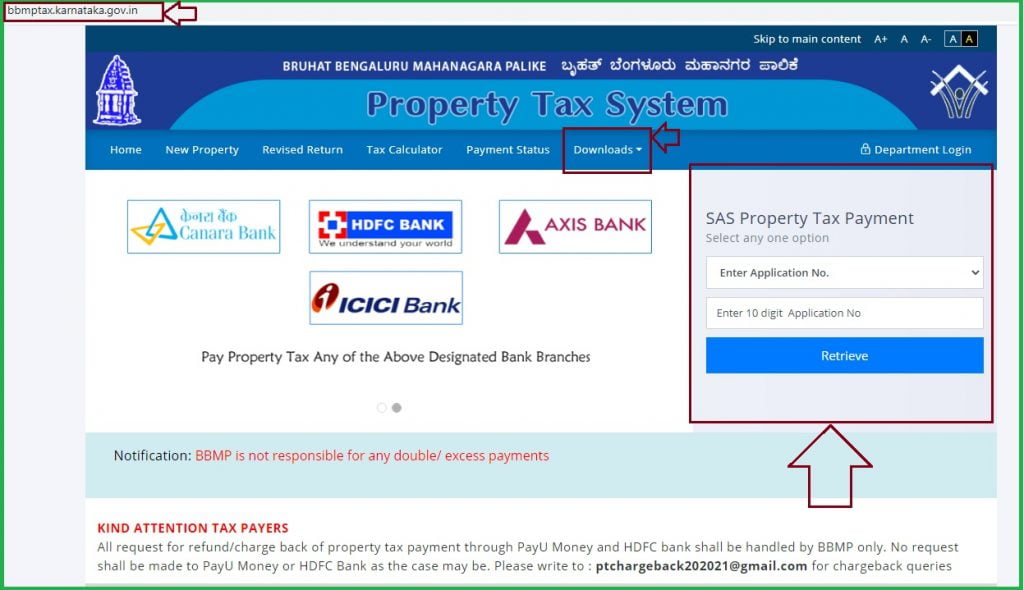

The BBMP Property Tax Payment Online 2025-26. Bangalore property tax (BBMP) online process at bbmptax.karnataka.gov.in. Receipt print, Challan print, Application form 2025-2026 print online step by step process.

BBMP Property Tax

Bangalore Property tax is the main source of income for many state governments in India. The tax is attached to many developmental activities such as maintaining the state public utilities, paying government employees, repairs and building of drainage system and many more. The Bangalore state government is one of the governments taking the property tax to digital levels and implementing an online payment system.

The Bangalore citizens can easily pay their property tax using the set website portal by the tax department. The municipal authorities collect Bangalore property tax from all the property owners. The property owners pay the required amount to Bruhat Bangalore Mahanagara Palike (BBMP) where they receive all details about the value of their property and the amount to pay.

Bbmptax.karnataka.gov.in

About Bangalore Property Tax

BBMP is attached with a lot of details which the taxpayer should know, they have to comply with the authorities to avoid penalties. The BBMP checks on different issues which add up the property value and the amount to pay for each property owner. Here there are various issues to check:

- The property classification, whether residential or commercial.

- The annual value for your property.

- Zonal classification and the dimensions of your property.

- The Built-up area of each floor and the total built-up area of the property.

- The basement and all floors of the property.

BBMP Property Tax Online Payment 2025-26

Property owners should pay their taxes on every financial year before the due dates. Any missed payments attract a certain percentage fine; however, early payments also comes with a discount of 5%. The BBMP tax dates are before April 30th for all property owners. They can pay via the online process as follows:

- Go to the official BBMP property tax website https://bbmptax.karnataka.gov.in/ portal.

- On the homepage, enter the SAS/ property identification number then click on “fetch” tab. The page will show details about the property owner. In case you cannot remember the application number click on the renewal application number button, next enter the previous year application for the SAS or PID number and proceed.

- The system will send the owner details using the previous year details, click “confirm” to proceed.

- A new page will show on the screen displaying a form IV, fill in all mandatory details as per your property.

- If the property owner wants to make any changes such as property usage, occupancy, dimensions and other related property details, they need to click on the proceed button. A new page will open producing form 5, enter the new changes and continue with the next process.

- Check in the information again before making an official payment. Now you can use the set payment modes from the portal. Select between online method or a use a challan to deposit it at the BBMP offices near you.

- For online payment property owners can use an e-wallet, debit card, credit card etc. The system will send a receipt after payment, note it might take 24 hours for the system to produce the receipt; however, it will still generate and post it on the portal.

- Download and print the receipt for reference.

Property tax forms OF BBMP

Property owners facing problems can contact the BBMP offices using the numbers:

| dcrev@bbmp.gov.in | |

| Phone number | 080-229705555 |

| Support line | 08022660000 |

Information on property tax zonal office numbers and payment due dates.

The Bangalore property tax payment official time is from 9:00 am to 12:30 pm and 3:00 to 7:00 pm. Property owners can also pay their tax from the tax offices or using the helpline number and follow the instructions. Note tax payment after the said dates will attract 2% penalty per month; you can also pay the amount in two instalments to avoid the interest. The amount should be paid before April 30th where the BBMP gives a discount of 5% to property owners paying before the date.

Property Considerable for BBMP Property Tax

- All residential property either for rent or for user residences.

- Factory buildings

- Office building and godowns.

- Commercial buildings

- Flats.

BBMP Property Calculation

Bangalore tax is calculated in three ways as follows:

The annual rental value system

BBMP calculates the gross yearly rent of the whole property and levies tax basing it on the anticipated value.

Capital value system

The market value of the property gives the amount of tax for the property.

Unite area system

The property tax is charged according to the property per-unit price of a carpet area.

BBMP Payment Status Check website link

https://bbmptax.karnataka.gov.in/Forms/continuepayment.aspx