The E-way bill portal guide, what is the e-way bill and generation process 2025. Eway Bill Login at https://www.ewaybillgst.gov.in.

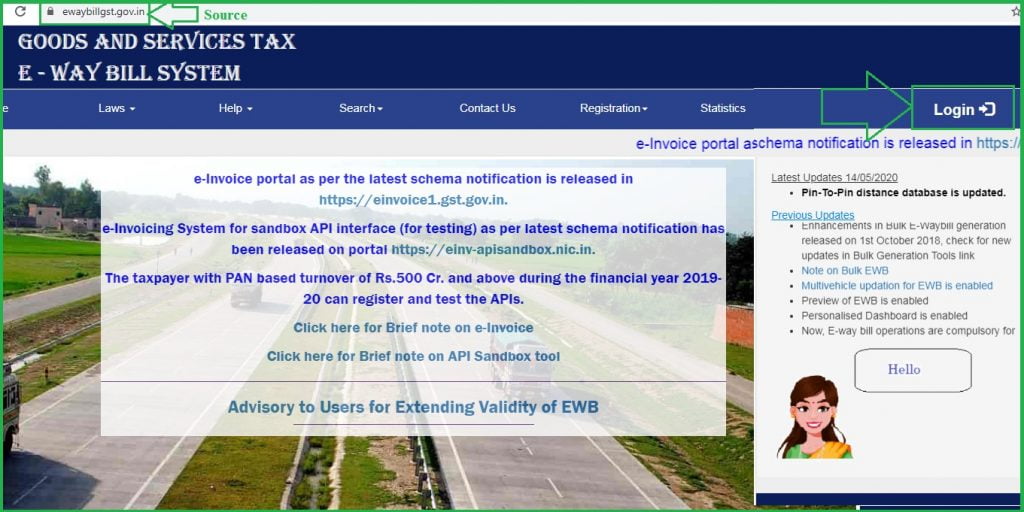

Eway Bill Login

The GST rules certify that all transporters have an e-way bill when moving goods from one point to another if they satisfy the given conditions. E-way bill means an Electronic waybill and acts as a unique electronic document that is generated to help move goods from one place to the other. The document is produced if the items have a value of more than INR 50,000. These apply to transporters moving either inter-state or intra-state. The e-way bill is the online soft copy form, which replaced the waybill manual document issued during the VAT times for moving goods in the country.

The government launched a website portal to help manage all the e-way bills; users can also cancel the bills directly through link https://www.ewaybillgst.gov.in The link works all over India for all transporters who need an eway bill.

Ewaybillgst.gov.in/login.aspx

Essentials for E-way Bill Generation

There are different reasons for generating an e-way bill as follows:

- The registration process on the EWB portal.

- To receive an invoice/challan related to the goods to transport.

- For road transportation, the transporter must produce a transporter id or the vehicle number.

- Transportation by ship, air, or rail, the transporter should provide transport proof documents, transporter id, and correct dates on the papers.

How to Generate E-way Bill on the E-Way Bill Portal

Step by step to Generate E-way Bill on E-way Bill Portal

- Visit the official e-way website https://ewaybillgst.gov.in/login.aspx

- On the homepage, enter the username and password, followed by the captcha code.

- Now click on the “log in” tab, next select the tab “generate new under” the option e-waybill.”

- Next, enter the following details:

- Transaction type on the page selects the option outward if you’re the supplier of the consignment.

- Inward if you’re the receipt of the goods.

- Sub-type chooses a sub-type that is relevant to your case.

- Outward transaction

- Inward transaction

- The document type can be a challan, invoice, credit note bill of entry, or others.

- Document number

- Document date

- From or to this depends if you’re the supplier or recipient.

- Item details the information is added on the HSN code-wise:

- The product name

- Description

- HSN code

- Quantity

- Unit

- Value

- Tax rates of the CGST and SGST

- Tax rates of cess.

- Transporter details enter transporter’s name, id, and document number. They should also provide a mode of transport and vehicle number.

- Recheck the details then click on the submit button for the system to validate the information.

The e-way bills website portal contains several tabs that users can follow and access information about the e-way bills.

Homepage Tabs

- Laws

- Help

- Search

- Contact us

- Registration

- Login

The above tabs help users maneuver through the portal; once you click on one of the tabs, there are different services to such as:

- The GSTIN

- All legal names and the type of user

- Notifications will appear on the same page, providing different details about the GST portal and E-way bill notices.

- The useful stat which contains the number or rejected e-way bills and total generated e-ways and canceled documents.

- The service tab

- Consolidated EWB

- Reject and reports tab.

- Update

- Registration

- Grievances