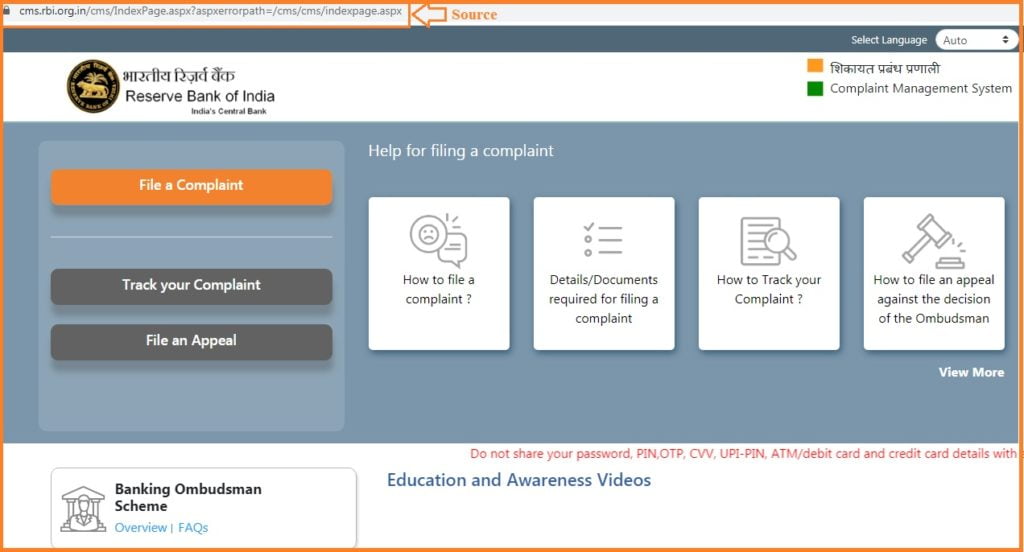

How to file a complaint with the Banking Ombudsman? Jurisdiction of banking Ombudsman, complaints and How to lodge a complaint at bank ombudsman website 2025 at https://cms.rbi.org.in/cms/indexpage.html#eng

Ombudsman

India country is among the largest and the most populated countries in the world. The country provides banking and financial systems to millions of citizens using different major and minor banks. Citizens can choose to be customers at any bank where they will receive banking services and other financial aids such as loans, investment plans, and insurance policies.

However, all banks work under the ‘Reserved bank of India RBI,’ which controls all banking systems. India banks are answerable and receive direction from the RBI to help run bank business smoothly. The body also looks into matters concerning customer satisfaction if customers face problems at their bank branches. They can make a complaint at the customer cares desk. However, if the problem is not solve after several complaints, the customer can use the banking Ombudsman scheme to set the RBI.

The account holder should first take the complaint to their respective Bank, launch the complaint which the Bank should solve. The RBI has issued all banks a specific duration to resolve the cardholder’s complaint. If the banks take longer, the RBI will intervene on behalf of the customer using the banking Ombudsman scheme 2006.

What is Banking Ombudsman?

There is official personnel of RBI appointed to help address complaint launched by the bank customer against specific banking and financial services. The personnel is only relevant if the complaint is beyond the set complaint days set by RBI.

Jurisdiction of Banking Ombudsman

Banking Ombudsman will handle all the applicants’ grievances; the personnel is responsible for the RBI orders. The Banking Ombudsman will report to the Governor of Reserve Bank every 30th June every year. He shall state the affair and give the general reviews of every activity conducted in his office during the previous financial year.

Reasons for a Complaint Can Be Filed With Banking Ombudsman

RBI has laid several rules which the banking ombudsman should follow, not all complaints are consider. Customers should read the scheme’s Act to know what they can take to the next level.

- A non-payment or inordinate delay in payment or collection of cheque, drafts, and bills.

- The Bank is not acceptable without any sufficient reasons or cause small denomination notes present for any purpose if the Bank charges commission due to the notes.

- For not accepting coin without any sufficient reason or charging the customer a commission for the same reason.

- Non-payment or delaying in payment of inward remittances.

- If the Bank doesn’t adhere to the prescribed working hours.

- For failure by the Bank to fulfill or delay a banking facility (other than loans and advances) promised by either writing by the Bank or the Bank’s sales agents.

- A complaint from Non-Indian residents having accounts in the country for issues related to remittances from abroad, deposits, and all banking-related matters.

- If the Bank refuses to open a deposit account without any valid reason.

- For levying charges on customers’ accounts without notifying the customer first.

- If the Bank doesn’t adhere to the Reserve Bank instructions on ATM/debit card or other prepaid card operations in the country.

- If the Bank doesn’t adhere to the Reserve Bank services on the mobile banking services in India by the Bank.

- For non-disbursement of pension funds or delaying of the service.

- Refusal without reason or delaying to accept payments towards taxes as directed by the RBI.

- If the Bank closed deposit accounts without providing notice to the customer or not giving sufficient reason.

- For refusal in closing or delaying to close an account.

- Non-adherence to the fair practices code as provided by the Bank.

- Any defect in services concerning loans and advances.

How to File a Complaint with The Banking Ombudsman?

Lodge complaint with Banking Ombudsman of RBI

- Visit the official website link Direct Link https://cms.rbi.org.in/

- On the homepage, select the tab “file complaint.”

- On the menu, select the location of “BO” depending on your complaint and then select the bank branch.

- Next, enter the description of the complaint, recheck for mistakes then click submit.

- The portal will send you a reference number, click to download the figure in pdf for reference.

- On receiving the complaint, the Banking Ombudsman will look into the mater. The personnel will check and get a satisfactory answer or resolution within 30 days.

Cms.rbi.org.in

Complaint by Email

Applicants can make a complaint using email services, sending a grievance to the Banking Ombudsman email is done through https://www.rbi.org.in/commonman/English/Scripts/AgainstBankABO.aspx

The claim is directly received and solved within 30 days by the authority. If the applicant is not yet satisfied with the decision, they take the case to the customer court.

RBI Complaint Status

Visit this URL https://www.rbi.org.in/Scripts/Complaints.aspx

For more information about banking ombudsman please visit the official web homepage given above.

How to track Banking Ombudsman Complaint status

You can track your complaint status here https://cms.rbi.org.in/rbi/VividFlow/run/trackapplicationrbi?language=Auto

Direct URL for Banking Ombudsman Complaint form

https://cms.rbi.org.in/rbi/VividFlow/run/rbi?language=Auto