LIC Policy Status online process for registered users and new users. life insurance corporation of India (LIC) policy status without registration 2025 (By sending SMS) at licindia.in

LIC Policy Status

The life insurance corporation of India LIC is a famous and largest insurance company in Indian country. The company has a collaboration of over 245 insurance companies that offer services to millions of Indian citizens each year. It was officially established in 1956 and has ensured the customers are safe, well cover, and enjoying the policies. The company has a variety of policy which suit all ages from health to education and property insurance.

LIC has implemented different plans which they sell to customers under certain conditions. Over the years, the company has grown its technology and incorporated a new digital system for its clients. One can check their policy or buy one without visiting the company offices. The online portal helps customers view every detail from their mobile devices. They can learn the status of the system by just following few steps online.

How to Check LIC Policy Status Without Registration?

Step by step procedure to Check LIC policy status without registration 2025

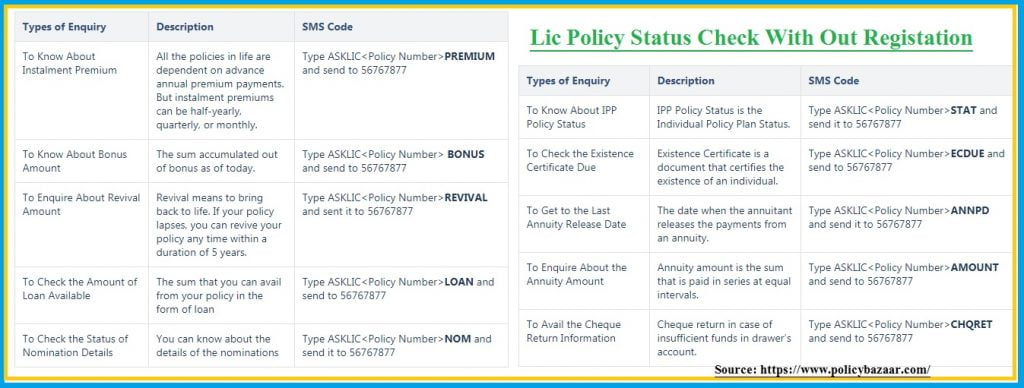

- Users can also check their LIC policy using a simple SMS method.

- The company offers an SMS number for easy checking process.

- Avail your LIC details by sending an SMS to 56767877

- They can check the status through the same number and the following descriptions.

How to Check LIC Policy Status Online?

For registered users online process

Registered users can visit the official website and check the status of any LIC policy. The payments, requests, bonuses, and schemes. The steps below help in status check through the online process.

- Visit the e-service LIC policy website portal https://www.licindia.in/Customer-Services/Policy-Status.

- On the homepage, the screen will show two options:

- New user & Registered user.

- Enter the registered option and proceed to key in your credentials such as user id and password.

- Once login into the LIC account page, you will find different policy options, click on the policy status button.

- The page will show all the respective policy accounts; the user has the choice to add a policy that is not listed on the account. Click on the tab enroll policy using the LICs e-service tools.

- Check the status of the policy by click on the policy number from the list. The details like policy name, policy term, table number, premium date, and the total sum assured will show on the screen.

LIC Policy Status Online Check for New User

The e-service portal has a registration option for new users who wish to enroll for LIC policy cover. The new user will fill their credentials and offer some proof documents for recording. Below we have steps to follow.

- Go to the official LIC website page, and on the homepage, select the tab online services tab.

- https://licindia.in/Home-(1)/LICOnlineServicePortal

- Click on the e-service official link, which will direct you to a new page indicated as a new user.

- On selecting the new user tab, a new page will open, here enter correct details about your policy.

- Policy number must be in your name and valid according to the LIC policies.

- All the installment premium the amount paid every month.

- Your date of birth in the format DD/MM/YYYY.

- Registered mobile number to help receive policy alerts such as payments, policy maturity period, etc.

- Registered email address.

- Recheck all details, and if correct, select the proceed button. Note the system will automatically delete invalid information within five working days.

- Now choose the user id and password confirm and click on the submit button. With the details, the new user can log in to the policy account for status checks and other insurance activities.

How to Enroll LIC Policy Online?

- On the official LIC policy website, the page will display a request, “do you have any LIC policy” on clicking the “yes tab. The page will reflect an online LIC policy enrollment form.

- Enter all the required details such as the name of the life assured, the premium to pay, policy number for each policy and many more

- The user can take a printout for reference one they complete filling the form. You can also download later the policy number after the registration process.

- The life assured or proposer is eligible for the policies; after filling the enrolment form, they can submit it to the nearest branch. The LIC officials will offer an acknowledgment letter on your user id.

- The whole process will be verified after all necessary documents and details fit the LIC policy agendas.

- The LIC company offers different ways of premium payments from annual, monthly, quarterly, or half annually.

LIC Policy Status for a Surrender Value

The LIC policyholder can calculate the surrender value of their policy through the formula below:

The necessary sum assured (the number of premiums paid/total number of premium payable) + total bonus received*surrender value factor.

Taking the LIC Jeevan Anand policy, if the surrender value applies after three active years of the LIC policy, which is equal to 30% of all premium expect the paid premiums of the first year plus the vested bonus. However, the accident benefit will not be accounted for to compute the surrender value.

Note bonuses are the additional amount paid at the time of death and when the policy term is over,

- LIC policy years 2010 (15 years’ policy)

- The basic sum for the assured RS 4 lakh (annual premium amount Rs.30,192/-)

- Bonuses collection Rs.70,000/-

- Assumption if you have paid 5 premuims, your policy surrender will be 30%.

- (5*30,192) +final bonus in today’s term

The sum applies for five years in the above example, users who have paid more than five years will have a different surrender value but using the same formula.

Download LIC Policy Status APP

You can download LIC Customer app (LIC policy Status) app from Playstore and apple apps store. Its available with free of cost.

| Apple mobile Users | https://apps.apple.com/in/app/lic-customer/id1324159013 |

| Android mobile Users | https://play.google.com/store/apps/details?id=com.lic.liccustomer&hl=en_IN |

Note: For more information about LIC India please visit this web official page https://www.licindia.in

How to check lic policy status without registration?

Lic policy holders can also check their LIC policy status sending a simple SMS method. life insurance corporation of india offers an SMS number for easy checking policy status without registration. Send SM to 56767877. From your registered mobile number

Lic call center number

LIC Customer care toll free number Contact ( LIC Call Center ) +91 022 6827 6827

lic policy status in force means

In general terms, “inforce” means “to make active”. In Life Insurance Policy terms, the policy which that is active i.e.,as if the customer keep on paying premiums time to time, then the policy will be in force. Otherwise if stop to pay premiums, then that Life Insurance Policy will cancel.

How to check LIC policy status using policy number?

Its very easy to check the lic policy status using policy number, by sending an SMS as below. Type ASKLIC , Send to 56767877.