National Pension Scheme NSDL Login and NPS Karvy Login. How to open nps account (NPS registration 2025) & NPS Karvy Login at Npscra.nsdl.co.in

NPS Login

Government employees are better placed in terms of pension saving schemes. The government has an automated system that deducts a particular percent of the salary and directs it to the pension account. The NPS is an example of a pension scheme benefit initially developed for government employees in India. However, NPS has extended its service to private corporate workers for better retirement planning.

The National Pension System was created in 2004 January by the Central government. The scheme served government employees only but later changes in 2009. Today all employees (self-employment, private and public sector) can utilize the NPS scheme without limitation. Eligible applicants should be 18 years to 65 years of age. The scheme doesn’t discriminate the religion or categories.

How to Open NPS Account (Registration)

Step by step NPS Online Registration 2025 Process

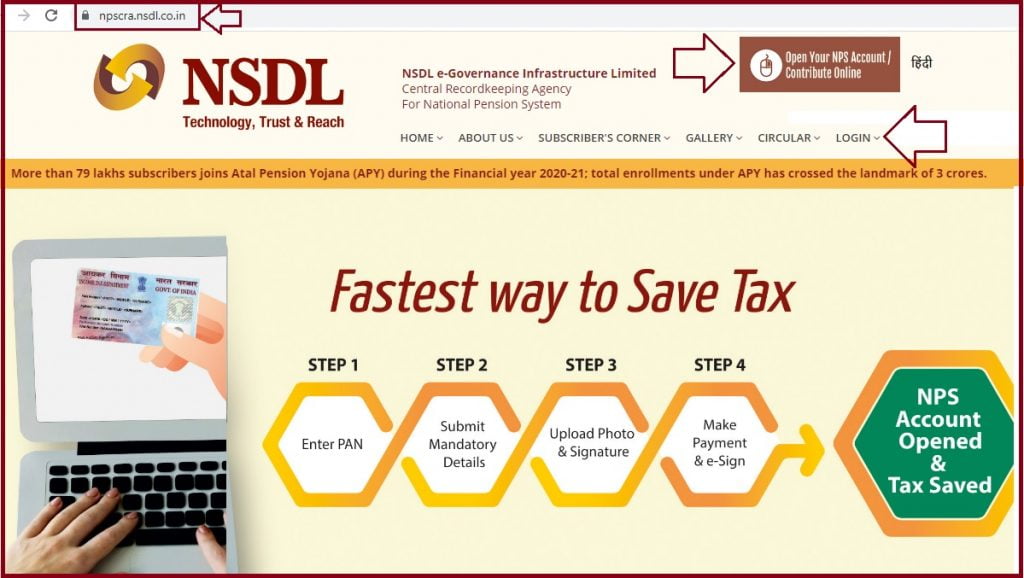

To access the NPS website page and service, the user needs to register on the page. Use the following steps to complete the registration process.

- Go to the NPS website page https://npscra.nsdl.co.in

- On the homepage, enter your Aadhaar or PAN number.

- Choose the NPS model you’re applying for the options: Central government, state government, Corporate or private citizen.

- Next, enter the required details such as professional data: Name, address, date of birth, contact details, educational qualification, and professional income.

- Next, enter the Bank account details: account name, bank branch, IFSC, MICR code, and more.

- Proceed and provide a nominee in case of death or dire situation.

- You can request for Tier-II account; the Tier-is opened by default during registration.

- Next, select the pension fund manager and enter the ratio which your wish to invest in.

Npscra.nsdl.co.in

Offline NPS Registration 2025 Process

To register through the offline method, the user needs to provide several details and documents. Ensure to provide a recent photograph, cheque, or demand draft for the first contribution. It would be best if you visited the NSDL office or PoP offices. Fill in the registration form and attach the required document. The NSDL officers will offer a PRAN number as an identity for the NPS account. Ensure to keep the number safe as it is required for every NPS transaction.

How to Login to NPS After Registration process

NPS members can use either of the three login processes. One can use the NSDL NPS portal, Karvy portal, internet banking account.

NPS NSDL Login Portal

National Pension Scheme (NPS) Login

- Go to the NSDL NPS portal using the link https://npscra.nsdl.co.in

- Select “open your NPS account/contribute online” from the homepage menu.

- Next, select the option “login with PRAN/PIN.”

- The option will lead you to the login screen.

- Enter the PRAN number and password and select the “submit” button.

- Note new users must create a new password for security purposes.

- Go to the NSDL NPS website page.

- Select the “open your NPS /contribution online” tab.

- Proceed to “Login with PRAN/IPIN.”

- A login screen will appear, select the option “password for e-NPS” to get a new password.

- Enter the PRAN, date of birth, new password, and confirmation of the new password.

- Recheck the details and enter the security code.

- Submit the information; the system will send an OTP to the registered mobile number.

- Enter the OTP code to verify the new password.

- Use the new password to log in to the portal.

NPS Karvy Login

Login Process Using Karvy NPS Portal

- Navigate to the Karvy NPS portal using E-F.Karvy.com

- On the homepage, click “login for existing subscribers.”

- The login screen will open, enter the PRAN and password to log in.

- For new users, follow the steps below:

- Open the portal and click “click here to generate password … reset your password.”

- The page will request for PRAN, date of birth, and security code.

- Recheck the details and select submit button.

- The system will send an OTP code to the registered mobile number.

- Key in the OTP to create a new password.

- Now you can log in to the E-NPS portal using the new password.

Internet Banking Account

To access e-NPS services, you can log in using an internet banking account. Open your internet banking account and proceed to the NPS section. You can access different NPS details such as contributions, selecting schemes, and other information.

The NPS has opened up a pension-saving practice among many people in India. The platform allows anyone to save for their future. NPS portal has simple features and offers the convenience of saving for retirement.

FAQ’s

When can one withdraw NPS funds?

NPS scheme was established for retirement benefits. However, the user can withdraw a certain percentage as directed by the NPS officials.

Who is eligible to join NPS?

The scheme was limited to government workers, but today, all employees from both private and public sectors can save their funds.

NPS Full Form

National Pension Scheme (NPS)

NPS withdrawal

Visit this for more information https://npscra.nsdl.co.in/all-faq-withdrawal.php