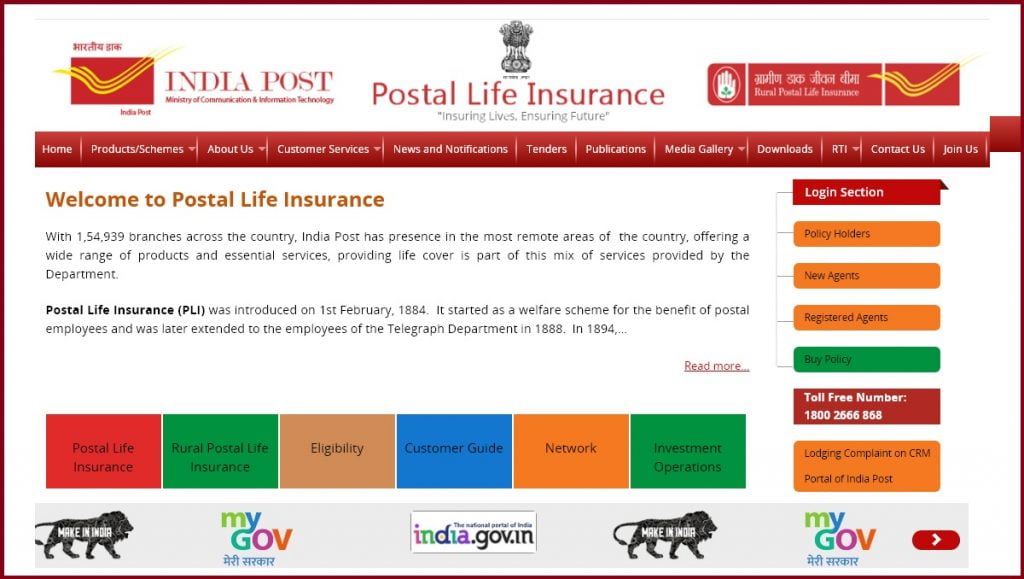

PLI Login – Postal Life insurance Registration 2026 process, PLI online payment, and PLI insurance status check at www.postallifeinsurance.gov.in (or) https://pli.indiapost.gov.in/CustomerPortal/Home.action

Postal Life Insurance

PLI dates back to 1884, offering various insurance policies. The Company limited its policy cover to postal department employees and later expanding to the telegraph department and general public. The insurance provider works with government employees, financial sectors, educational institutions, and other sectors in India. PLI has upgraded from traditional premium payments to new digitalized services. This allows premium holders to clear payments through online services.

The online platforms allow for transparency, fast processing, and reducing long queues at the PLI branch offices. Several PLI plans work with individuals or groups.

PLI

Name of PLI plans and Type of Plan

- Suraksha: it’s a whole life plan where the user benefits after attaining 80 years.

- Santosh: the policy is an endowment plan; it allows the policyholder to take loans after three years.

- Suvidha: It’s a convertible whole life plan; the user can change to an endowment plan after five years.

- Sumangal: this plan offers a money-back policy.

- Yugal Suraksha: the policy offers joint life insurance from couples.

- Bal Jeevan Bima: the plan covers children (child plan).

Pli.indiapost.gov.in/CustomerPortal/Home.action

How to Register for PLI Online Services (Rural postal life insurance)

- Go to the PLI branch office and register your mobile number and email ID.

- After providing the information, the PLI officer will log in the details on the PLI website portal.

- On the page, click the “generate customer Id tab.

- Next, the customer should fill in the mandatory information: policy number, sum assured, insured first name, email ID.

- The customer should recheck the information before submission.

- The system will send the customer ID to the email ID.

- A reset link will also appear on the email; use it to reset your login password.

Postal Life Insurance Online Payment

Step by step to Pay pli online payment

- Visit the PLI website page https://pli.indiapost.gov.in/.

- On the homepage, go to the login section and select “policy holders.”

- The login page will enter the customer ID, password, captcha code and click the login button.

- On the page, proceed to the payment section “premium payment.”

- Key in your credit card details to complete the premium payment.

LIC Premium Payment Through Mobile Banking

Postal life insurance allows users to pay premiums through mobile banking applications. One can opt for a credit card, net banking, and debit card, or more.

Options for paying PLI Premium Payments

- Postal Life Insurance website portal.

- Mobile banking app

- Fund transfer: the transfer from one account to another.

- Immediate payment service

- NEFT and RTGS

- UPI

- Aadhaar enabled payment system

- QR code

How to Check Postal Life Insurance Payment Status

- Go to the PLI (Postal Life insurance) website portal https://pli.indiapost.gov.in.

- On the login, section click “policyholders.”

- Enter your login credentials username and password.

- For a fresh proposal, go to “purchase a policy.”

- Next, select “proposal track” and enter the proposal number.

- The system will display the status on the screen.

Postal Life Insurance Policy Status Check

Status check through website portal (India post website)

- Visit the Indiapost official website page https://pli.indiapost.gov.in.

- On the homepage, click “insurance” >postal life insurance.”

- Click the “login” button and enter your customer ID and password.

- Next, enter the captcha code and select the login button.

- Once you log in, you can trace your policy status by giving the policy number details on the page.

- The system will generate status based on the policy selected.

Note the postal life insurance company also offers a toll-free number for users to enquire about any policy details.One can call to check policy status through the number 1800 1805232,155232 or landline number 011 24673177.

Guide on PLI Agent Login, PLI Agent Portal Pliagent.indiapost.gov.in

FAQ’s

Does PLI benefit individuals above 50 years?

Yes, the PLI Company offers insurance to all eligible applicants; the benefits are available for users until 55 years.

Can I continue paying for a policy after stopping for some time?

Policyholders can rejoin a policy after leaving due to some reasons. However, there are several benefits you cannot receive until four to five years are over.

PLI Full Form

Postal Life Insurance (PLI)

RPLI Full Form

Rural postal life insurance (RPLI)

pli indiapost gov in Customer Portal

https://pli.indiapost.gov.in/