State bank of India (SBI) RTGS form PDF download 2026 free. SBI NEFT Form download free PDF link given below. Visit link sbi.co.in/web/personal-banking/rtgs-neft

SBI RTGS Form

The online banking system is a popular platform today in different banks in India. Customers can access services without visiting the bank, operating from the comfort of their home. Many banks regard online banking systems, such as RTGS, as the best way to transfer funds online.

The process is easy, fast and secure; there are no delays or waiting for several working days the bank provides a website portal where customers can receive information on the online banking process. Note one can fill the SBI RTGS form and make transfers of more than Rs. 2 lakhs.

SBI NEFT Form

How to Fill RTGS Form of SBI Bank

The SBI bank has the form both online and offline according to customer’s preferences. The applicant should fill all mandatory information then submit either online or through the bank branch.

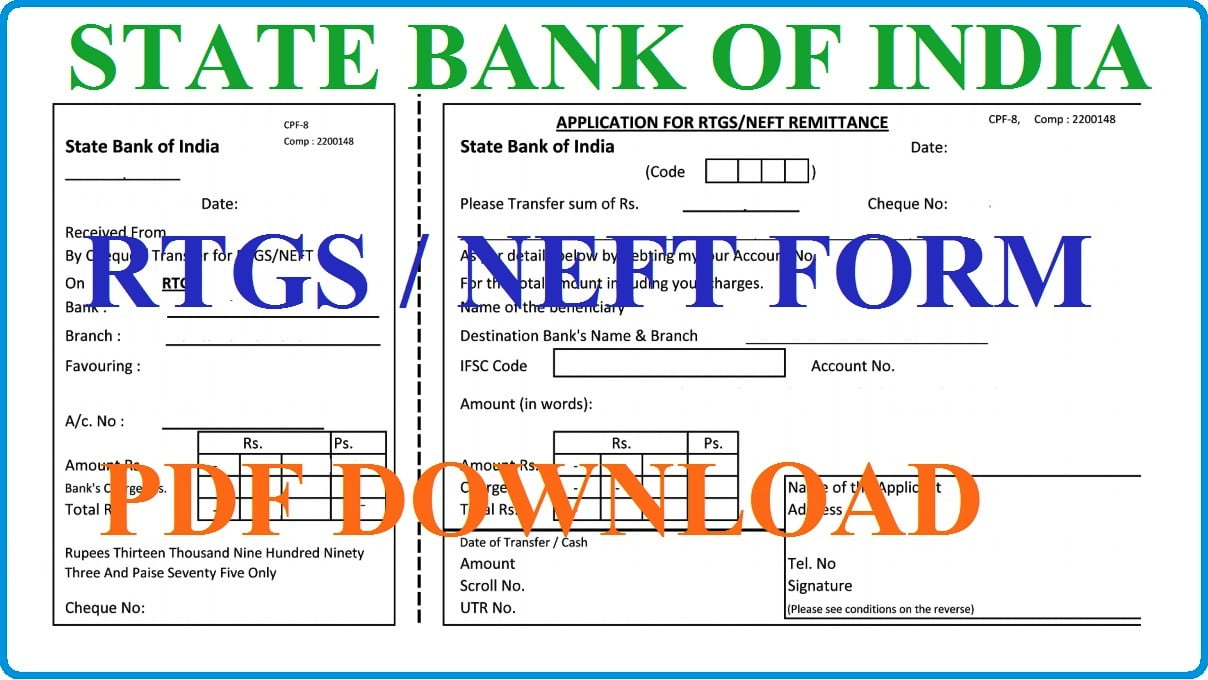

- On the RTGS/NEFT form, there are two sections the left section is for the customer to fill all the information and enter the proof documents. The right part is left for the bank officials to verify the details after filling.

- The RTGS form requires you to enter the senders account details, enter all beneficiary information, bank branch IFSC code of the beneficiary branch. The amount to transfer, enter the date, and your signature. Ensure all details are correct before submitting them.

- Submit the document to the bank officer who will enter all the details in the bank computer system.

- In cases where the amount is higher than the Rs. 2 lakh customer will have to provide a cheque together with the RTGS form. The bank will arrange a temporary cheque book if you have forgotten yours.

- The sender/originating and destination/beneficiary bank branches are included in the RTGS scheme.

- The form has to include the beneficiary information such as name, bank account, IFSC code and account type.

SBI RTGS Fund Transfer Through Bank (Offline)

SBI bank is one of the best banks in Indian country has millions of customers in and out of the country. The bank offers different banking services, which include online transactions. The bank offers money transfer using RTGS/NEFT services, which can also work offline. Customers need to visit the bank branch and fill the RTGS forms where the bank will make a point to transfer funds to the beneficiary account.

SBI RTGS Charges at Bank Branch

The RBI has no fixed price for the RTGS services banks are allowed to charge according to their rates. India NEFT transaction up to 1 lakh are no charges; however, for the RTGS charges apply from Rs. 25 to Rs.56, this depends on the amount you transfer, where higher amount attracts a higher charge.

The SBI RTGS system is always secure, and one can transfer funds without fear of theft. However, the bank advises users not to share any personal details to avoid information leakage. Applicants can add the number of beneficiaries if they don’t have them on the list, ensure all details such as beneficiary account number, account name and type are correct before making any transfer. For more visit https://www.sbi.co.in/web/personal-banking/rtgs-neft