Guide on How to Pay AP Municipal Tax Online Payment. Cdma.ap.gov.in | AP Property Tax Online Payment 2025. AP House tax, Shop tax online payment at https://cdma.ap.gov.in/en/ptpayments

Cdma.ap.gov.in Property Tax Online Payment

Paying taxes is pretty significant for state residents and the government. The funds help in public amenities such as roads, parks, schools, sewage lines, hospitals, etc. Indian state governments appoint various tax authorities (Municipals Corporation) to levy a tax based on location, property and value. The Andhra Pradesh state citizens can honour their tax payment through the CDMA AP government portal.

The CDMA body helps collect property/house tax from residential and non-residential property owners. The funds are directed to state development and growth. Property owners must pay their designated amount every year. AP house tax is the primary income source for the state’s urban local bodies (ULB). AP residents can avail of their taxes through the mobile app or CDMA AP website portal for a fast payment process.

Cdma.ap.gov.in

AP Property Tax Components

The AP municipal Corporation levies taxes on all residential property with an annual value above Rs. 600 and non-residential properties within the municipal. The property tax will include the following components:

- Water and drainage tax

- Lighting tax

- Scavenging tax

- General purpose tax.

Property Tax Assessment Components

The CDMA AP (Municipal Corporation) representative must visit the property and assess it to make the final property value. The process is determined by the following:

- Zone/location of the property

- The residential or non-residential status of the property

- Plinth Area

- Age

- Construction type

Assessment Report Details

After the assessment process, the government officials will send a report containing the following details:

- Serial number

- Property owner’s name

- Door number

- Locality

- Zone number

- Construction type

- Usage

- Plinth area

- Monthly rental value

- Half-yearly property tax

- Special notice service

- Date of hearing

- Commissioner’s order

Property Tax Rates

House tax depends on residential property; if the building’s annual rental value is below or up to Rs. 600, it’s exempted from tax.

| Residential building: ARV | Rate of property tax |

| Rs. 601 to Rs. 1200 | 17% |

| Rs.1201 to Rs. 2400 | 19% |

| Rs. 2401 to Rs. 3600 | 22% |

| Above Rs. 3600 | 30% |

AP Property Tax Online Payment

AP Property Tax Payment 2025-26 Pay Andhra Pradesh House Tax, Shop tax, Land tax Bill Online

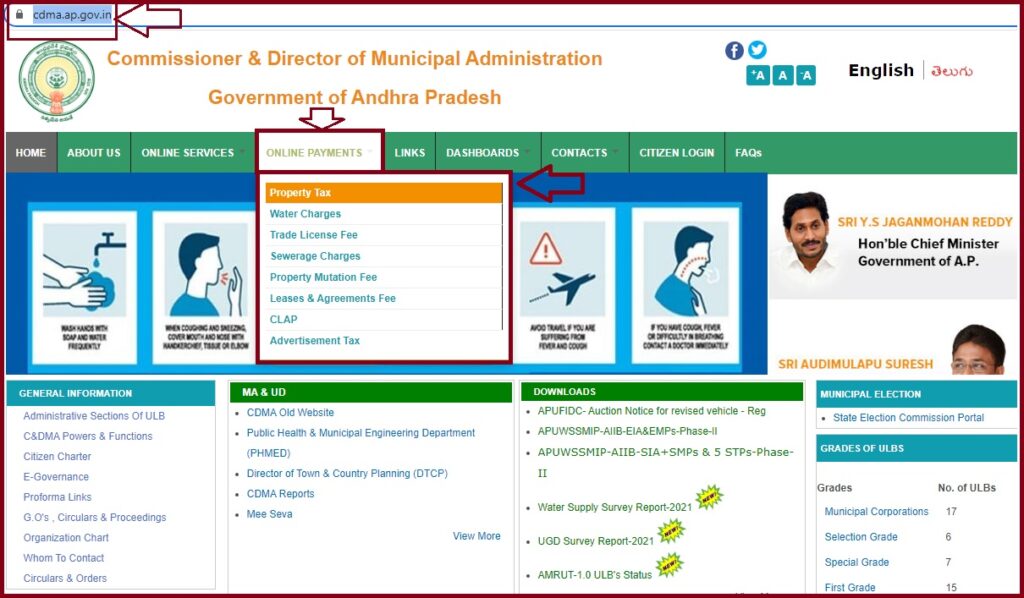

Visit the CDMA AP website portal

https://cdma.ap.gov.in (or) https://cdma.ap.gov.in/en/ptpayments

Select option in the CDMA Homepage

the “online payment” option > “property tax” option.

Next, click the district Municipal Corporation and press the search button.

A new page will open; enter required details like assessment number, old assessment number, name, door number, etc.; use either option and select the search tab.

The system will show the property details, such as net payable property tax

Next, the page will open two options: pay tax or view DCB.

To pay the tax online

click “pay tax” for the offline method and select the view and print tab.

Enter the amount shown on the balance amount section and press the CFMS payment gateway

Read the terms and conditions and press the accept tab to continue.

Next, click “pay online” > “online payment” to open different modes (credit/debit card, internet banking).

The system will display the payment receipt on the screen.Download and print the receipt for reference.

| AP Districts List | Municipal Corporations |

| Anantapur | Anantapur |

| Chittoor | Chittoor |

| East Godavari | Rajamahendravaram |

| Eluru | Eluru |

| Guntur | Guntur Mangalagiri-Tadepalli |

| Kadapa | Kadapa |

| Kakinada | Kakinada |

| Krishna | Machilipatnam |

| Kurnool | Kurnool |

| Nellore | Nellore |

| NTR | Vijayawada |

| Prakasam | Ongole |

| Srikakulam | Srikakulam |

| Tirupati | Tirupati |

| Visakhapatnam, Anakapalli | Visakhapatnam |

| Vizianagaram | Vizianagaram |

How to Pay CDMA AP Property Tax Using PuraSeva

- Go to the PuraSeva app link on your device.

- Enter various details like district, corporation and payment type.

- Select your preferred option and select the submit button.

- Next, enter your property tax details and select the search option.

- The system will generate property tax information based on the assessment data.

- Review the information and press “pay tax” to open the payment page.

- Make the payment using your favorite gateway (internet banking, credit card or debit card).

- The system will send an acknowledgment ID to verify the transaction.

Andhra Pradesh state property owners can also complete the payment using e-Seva centers portals or visit the PuraSeva Centre in person.

FAQ’s

What are the required details for AP property tax payment?

The user must have an assessment number, name, property address and Aadhaar number.

What is the official web page for AP property tax details?

AP residents can check property tax details through the link https://cdma.ap.gov.in/en.

AP CDMA Full form

Andhra Pradesh Commissioner and Director of Municipal Administration (AP CDMA)

For more information about Cdma.ap.gov.in | Property Tax Online Payment visit this link