The EDMC Property Tax Payment Online 2025: East Delhi Municipal Corporation property tax 2022-2023-2024-2025-2026 pay at https://mcdonline.nic.in/portal

EDMC Property Tax

East Delhi Municipal Corporation Property tax is valued as the primary source of revenue for any urban or local municipal authorities. The funds help maintain the city and pay the municipal employees. Every property owner should pay the allocated amount by the authority and avoid fines. The MCD of Delhi collects the property tax from the city property owners. These help keep everything in order catering for every service.

All Delhi property owners should pay their taxes to the East, North, and South Municipal Corporation of Delhi. The authority requires individuals to pay their taxes according to the zonal areas. There is then divided into wards and colonies. Ensure to learn your areas to pay the right municipal council. The East Delhi Municipal has two zones Shahdara south Shahdara North, which are divide into a zone, wards, and colonies.

Mcdonline.nic.in/portal

https://mcdonline.nic.in/ptrmcd/web/citizen/property/allSearch

How to Pay EDMC Property Tax

The EDMC has set two legal ways to pay for property tax. With the online and offline methods, property owners can visit the ITZ centers and pay for the tax offline.

Online method.

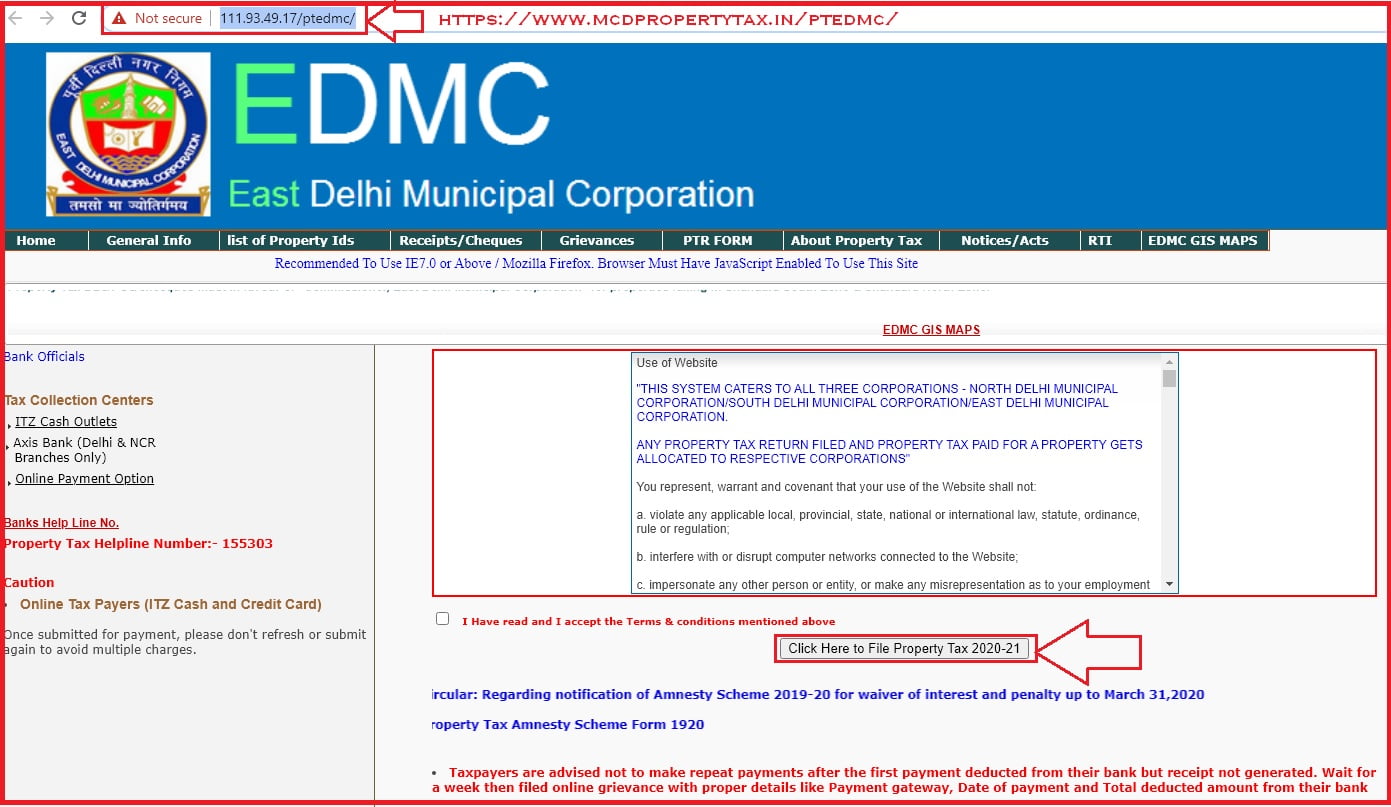

- Visit the official EDMC website portal using the portal https://mcdonline.nic.in/edmcportal/service

- On the homepage, check the box to agree with the terms and conditions of the tax department.

- Next, select the option “click here to file property tax (year).

- You can choose to use the property id for tax paid in 2014-15 or any other years, then select “submit.”

- For users without property, id selects the tab “click hereto file your return.”

- This applies if the property tax hasn’t been issue before.

- The portal will open a new page with property ownership details.

- Enter all the required property details to proceed.

- Now compute the tax, then click the submit button.

- Enter the amount and pay the tax to complete the process.

- Next, click the tab “generate challan” the system will display the challan on the screen.

How to Calculate EDMC Property Tax

To arrive at individual property tax, the EDMC uses a “unit area system” to calculate property tax. They use the formula:

- Property tax= annual value*rate of tax

- The annual value= unit area value per sq. meter*unit area of the property –age factor-use factor-structure factor-occupancy factor.

Due Date and Penalty

Property tax payment has a particular date set by the tax authorities—individuals who don’t make payments get hefty fines.

- Property tax should be paid once before the first quarter or 30th June. Anyone who makes this kind of payment receives a rebate of 15% of the total tax.

- If the payments are made later or past the due date, this will attract a penalty interest of 1% for every month delayed.

Offline property tax payment

Individuals can still use the offline method to pay taxes. One needs to visit the ITZ offices or cash counters in EDMC. Make the payments by providing your details at the counter. Provide the cash, and the officer will provide a payment receipt that has the property id. Keep the receipt for reference, especially the property id.

EDMC Property Tax Receipts Download 2025

https://mcdonline.nic.in/ptrmcd/web/citizen/info

EDMC property tax Find By Name

https://mcdonline.nic.in/ptrmcd/web/citizen/property/allSearch