Navi Mumbai Property Tax Payment Online 2025| NMMC Property Tax online payment 2025-26 at https://www.nmmc.gov.in/property-tax2

NMMC Property Tax

Property owners offer significant financial and developmental services to municipalities and cities. Most facilities rely on property tax payments to operate. To govern taxes, every region has a governing municipal corporation. The body collects and disburses the fund to required activities such as road construction, sewage collection, and other public amenities. The fund help run cities and serve residents through different government incentives.

Mumbai is a vast city that holds several municipalities; each region is managed by Municipal Corporation for easy collection. The Navi Mumbai municipal gets services from NMMC (Navi Mumbai Municipal Corporation). Residents pay their property taxes and other taxes to NMMC using online or offline means. Property owners can visit the official NMMC property tax website https://www.nmmc.gov.in/navimumbai/ to access comprehensive tax details. One can check their pending balances, tax calculations, tax exception and more.

NMMC classifies property as residential, non-residential/commercial and industrial. Navi Mumbai citizens with land, buildings, or property must pay their yearly property tax before the due date.

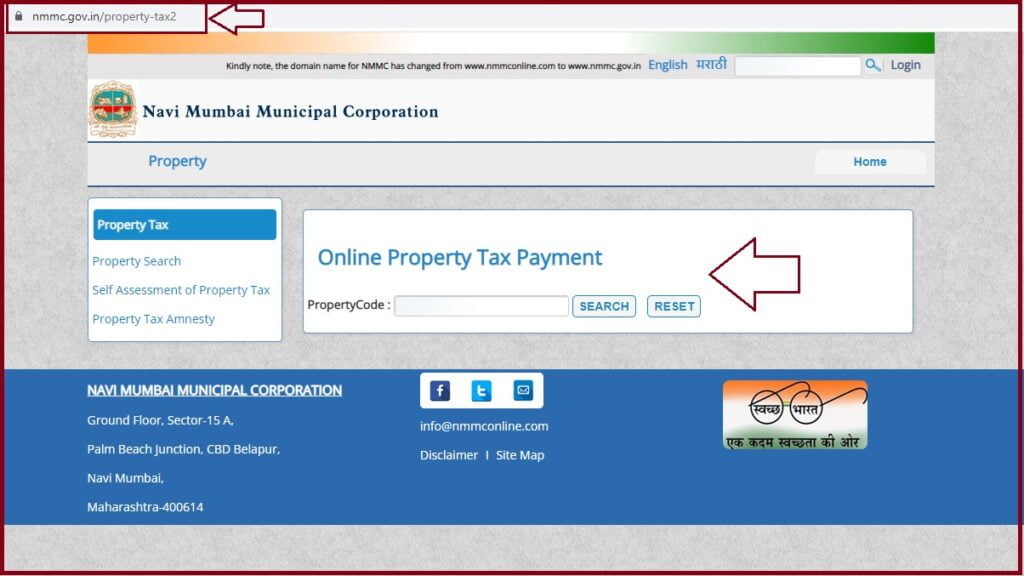

Nmmc.gov.in/property-tax2

| URL Name | URL |

|---|---|

| Online Property Tax Payment | https://www.nmmc.gov.in/property-tax2 |

| Property Search | https://www.nmmc.gov.in/property-search |

| Property Tax Calculator | https://www.nmmc.gov.in/self-assessment-of-property-tax |

| Amnesty Scheme for Property Tax | https://www.nmmc.gov.in/property-tax-amnesty |

| Sign-up | https://www.nmmc.gov.in/home?p_p_id=58&p_p_lifecycle=1&p_p_state=maximized&p_p_mode=view&saveLastPath=0&_58_struts_action=%2Flogin%2Fcreate_account |

| Downloads | https://www.nmmc.gov.in/downloads |

NMMC Property Tax Payment Using Property Code Search

Property owners can search for their property details using the property code. The details will help complete property tax through the NMMC website.

- Visit the NMMC website portal link https://www.nmmc.gov.in/property-tax2.

- Proceed to the “property tax” section and enter your “property code.”

- Press the search button to get the property code details.

- A new page will open and display the following details:

- Property owner’s name

- Address

- Type of property

- Principal amount

- Penalties (if any)

- Outstanding amount

- Next, proceed to the payment page and select the “pay online” option.

- The system will open various details like item code, customer’s name and amount.

- Any payment after the required details will incur “Delay payment charges” DPC.

- Select different payment options: internet banking, credit card, debit card, NEFT/RTGS and e-wallet.

- After payment, the system will generate a reference number. Take a print of the receipt for reference.

Offline Payment of Navi Mumbai Property Tax Payment 2025-26

Property holders who wish to pay their taxes offline can complete the process using the steps below:

- Go to the official website page.

- Select the “property code” tab and click the search button.

- Direct link: https://www.nmmc.gov.in/property-search

- A new page will open and display property details.

- Proceed to the payment page and select the offline option.

- Next, download the payment challan and deposit it to the nearest ward office.

How To View NMMC Property Tax Bill

- Go to the NMMC website portal https://www.nmmc.gov.in/navimumbai/

- Open the homepage menu and select the “view current bill” option.

- The page will display your bill on the screen.

Steps to View the NMMC Property Tax Ledger

Property owners seeking property ledger details can visit the website using the steps below:

- Navigate the Navi Mumbai Municipal Corporation website.

- Proceed to the “view ledger” tab.

- The system will display the following details:

- Date

- Reference

- Demand (s)

- Collections

- Penalty

- Total

- Remarks

- Receipt

How to Register for NMMC Property Tax Alert/ E-demand/ SMS Alert

Property alerts help users pay their taxes before due dates and avoid penalties. It also helps communicate easily with property owners who get notifications on time. To register for the service, use the steps below.

- Go to the NMMC property tax web page.

- Select the “Register for E-demand/SMS Alert” option.

- A pop-up message will show; enter the required details:

- Property code

- Email ID

- Mobile number

- Review the details and press the “register” option to complete the process.

How to Search for Property Details Online

To avail property details, property owners can search the information through the NMMC portal as follows:

- Go to the official website portal.

- Select the “property search” tab under the NMMC property tax link.

- The NMMC page will open; enter the following details:

- Ward

- Sector

- Plot

- Building

- Property owner

- Next, click the “search” tab.

- The system will display the owner’s name, property code, address, ward, sector, and plot.

How to Calculate NMMC Property Tax

Navi Mumbai property tax interest rate ranges from 5% to 20%. Property owners can calculate their taxes via the NMMC portal using the formula below:

- NMMC Property tax = built-up area * age factor * base value *type of building * category of use * floor factor.

The calculations are determined by:

- Type of property (residential or commercial)

- Age

- Year of construction

- Use

- Single-floor or multiple

- Base value

- Occupancy

NMMC Property Tax Name Change

Individuals willing to change property name due to inheritance, death, or marriage need to present several documents:

- A copy of the previous NMMC property tax bill.

- An attested copy of the deed showing the name change.

- No objection certificate from the housing society approving the new name.

MCGM Property Tax Payment Online 2024-25

FAQ’s

Can I pay NMMC property tax using the mobile app?

The NMMC has a simple mobile app called e-connect for easy property tax payment. It’s available in all operating systems.

When is the last date of NMMC property tax in 2025-26?

Property holders must pay their taxes within the financial year 2025-26 is June 30, 2025.

NMMC Full Form?

Navi Mumbai municipal corporation (NMMC)