The GST Certificate Download 2025 : How to download gst registration certificate online at https://www.gst.gov.in step by step procedure given below.

GST Certificate Download

The GST Act expects every individual registered under GST to acquire a GST certificate. (GST, REG-06). If the supplies of goods get an annual turnover of more than Rs. 40lakh. The individual must register under the GST. Suppliers of goods in special category states need yearly aggregate turnover, which exceeds Rs.20 lakhs to register. The GST registration covers manufacturers and traders whose annual turnover is Rs.1.5 Crore. They should register as composition Dealers under the GST law. However, there are groups of people irrespective of their yearly turnover. They must register under GST.

GST registration happens online. Once completed, you need to download the certificate. The government doesn’t issue hard copy certificate. Use the official link to download the soft copy certificate https://gst.gov.in.

Download GST Certificate Online

You can download gst registration certificate online with in minutes of time. Just follow this simple procedure given below.

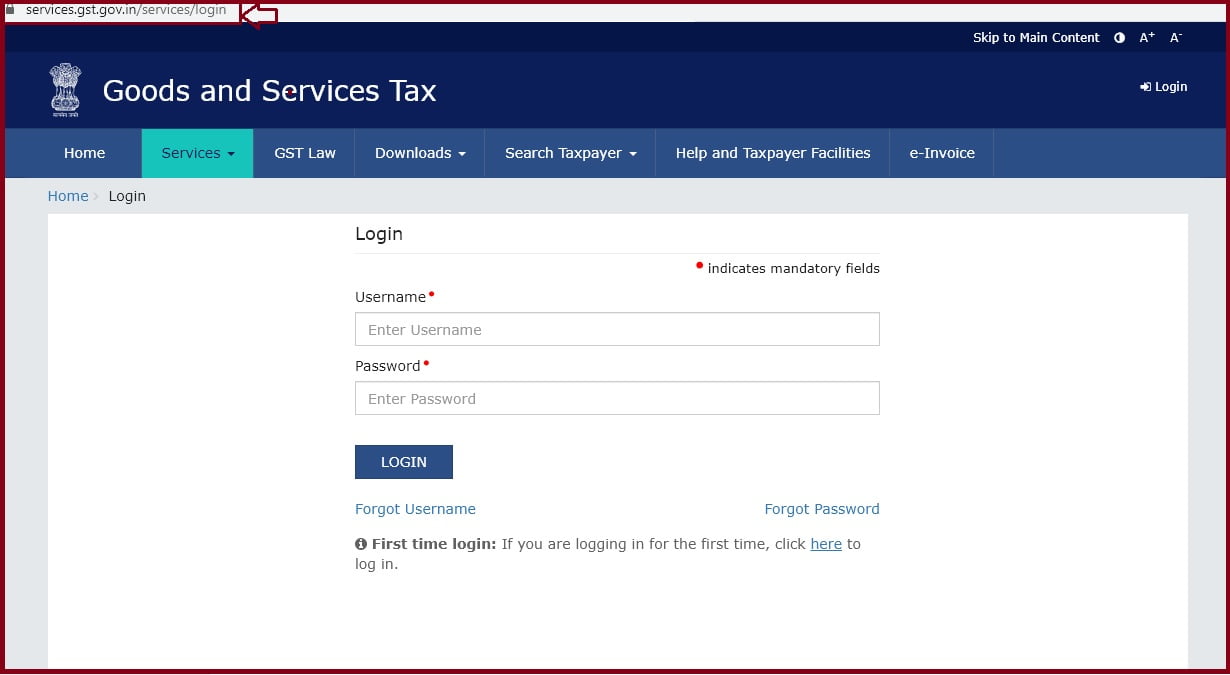

- Go to the GST website page https://gst.gov.in.

- On the homepage, login using your login details (username and password).

- On the service tab, click the option “user services.” Proceed and click the tab “view/download certificate” from the list.

- Select the download button next to the registration certificate. The system will download the certificate to take a printout for reference.

GST Registration Certificate Format

The GST registration certificate comprises three pages booklet. It’s contained in the form of GST REG-06. Each page has different information. The first page displays the principal place of business.

Page One

- The GSTIN of the individual or business/company.

- Legal name

- Trade name (optional)

- Constitution of the business.

- The address of the principal place of business.

- The date of liability.

- For non-resident and casual taxable persons, the certificate sows a period of validity.

- Type of registration.

- Approving authority.

- Date of issue of the registration certificate.

Page Two

- GSTIN of the individual or business.

- The legal name

- Trade name

- The total number of additional places of business in the state.

Page Three

The page contains a person or person’s details and information about the business. Here you find information such as the sole proprietor, partners, Karta, managing director, full-time manager, etc.

- GSTIN of an individual or business.

- Name

- Designation or status

- Resident of state

- Photo.

The GST law requires anyone registered under GST. To display their GST certificate at a visible place at the business or businesses. They also need to display the certificate on the name board’s signboard at the business place.

GST Certificate Verification

The GST portal has a verification and search tool under the option “search by taxpayer.” The applicant should click the option and fill in the GSTIN details. These will help check the authenticity of the certificate. Once you feed the GST details on the search bar, the portal will provide all legal information and verify if the certificate is genuine.

The GST Registration Number

The GST number is made of 15 digits; it’s PAN-based and is specified according to the state.

- The first two numbers show the state code.

- The other ten digits are the PAN or TAN of the taxpayer.

- The 13th digitshows the number of registration under the same PAN card.

- The 14th character is by default “Z,” showing the nature of business.

- The last number is the check code.

How to Amend GST Registration 2025

In some cases, the taxpayer may wish to change the GST details. They can change the address, contact number, or business details. You must apply for GST REG-14. There are two types of amendments:

- Amendments of core fields

- Amendments of non-core fields

- Visit the official GST website portal https://www.gst.gov.in.

- On the homepage, enter your password and username to log in.

- On the menu, select the option services, and proceed to registration.

- Now click on the option amendment of registration core fields.

- Enter the required changes in the form of GST REG-14. You need to upload the proof documents to proceed.

- The system will verify the details and make the changes. Download and print the GST certificate for reference.

Also read: How to Fill GST Return Forms Online: A Step-by-Step Guide

GST ka full form

Goods and Services Tax (GST)