GST Login | Ewaybill GST Login | Cleartax Good Services Tax login 2025 at Gst.gov.in & https://ewaybillgst.gov.in/login.aspx

GST Login

The Indian government has a legal tax platform known as GST, which helps facilitate taxpayers’ different services. The GST portal ( www.gst.gov.in ) offers GST registration services, filing of GST returns, and application for refunds (is you apply for cancellation). The tax department has eased the hassle for taxpayers. The new GST portal is advance with current technology. Taxpayers don’t have to line up at the tax offices anymore.

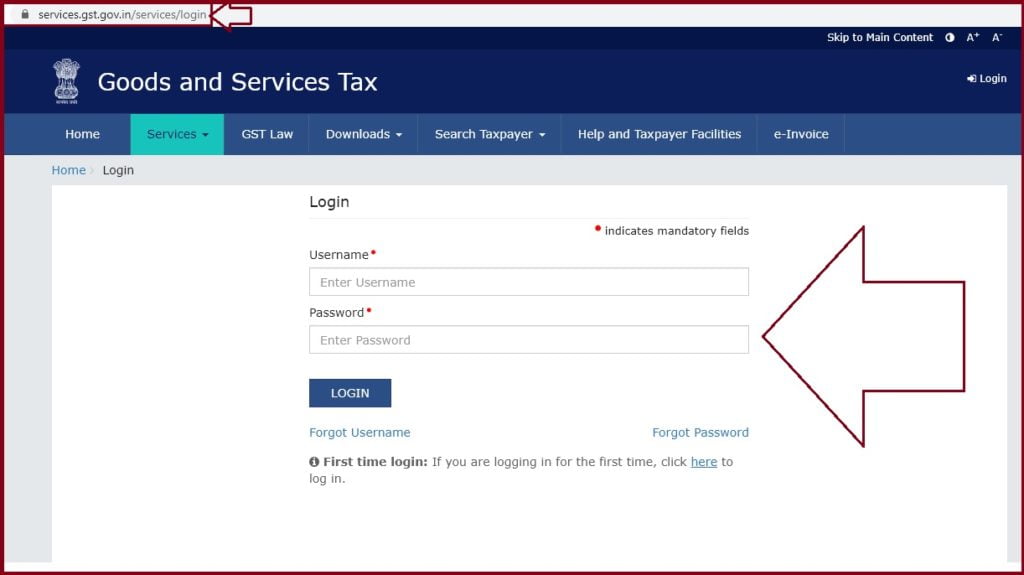

Services.gst.gov.in/services/login

The GST India has benefits for both consumers and trades as follows:

- The service provides uniform prices in the country.

- No corruption cases since the portal are transparent. Helps create employment opportunities.

- The prices of goods and services are subsidized.

- There are fewer rates and exemptions.

- No distinguishing goods and services.

- It helps reduces the collection of taxes.

Services in the GST Website Portal

The portal has various services that taxpayers can perform anywhere through the internet.

GST Registration

The registration process is now eased as normal taxpayers, ISD, and casual dealers can access the GST portal. On the page, click the application for registration services.

The Application Process for the Practitioner

Enter all the mandatory details to register as a practitioner.

GST Payment Services

- Claiming a refund for excess GST paid.

- Filling tax returns

- E-ledger services

- Filling the table 6A of GSTR-1.

How to Login GST Website

- Visit the official GST Portal website page using the link https://www.gst.gov.in.

- Direct Link https://services.gst.gov.in/services/login

- On the homepage, click the tab “login” the login page will open enter your username and password.

- Next, enter the captcha code to verify the details.

- Now click the login button to open the Good Services Tax page and access the services.

How to fill GST Online Application 2025

The government requires taxpayers with goods exceeding Rs.20 lakhs to register through the GST portal. They need several documents, such as:

Aadhaar card of the applicant

- PAN card

- Digital signature

- A letter of authorization

- Proof documents for business registration.

- Open the GST webportal page at www.gst.gov.in

- On the homepage, the menu goes to the option “services” the tab will generate all the portal services.

- Select the Registration option and get the online application form.

- Enter the mandatory details such as Name, PAN card number, mobile number, email id, state, etc.

- Next, enter the OTP number sent to your email id or mobile number.

- After the verification process, you will receive a reference number.

The GST web portal may sometimes display some errors when the taxpayers try to log in. The error” failed to establish connection to the server. Kindly start the Emsigner.” The Emsigner is used for DSC to help in the proper functioning of the GST portal. To solve the problem, one needs to ensure their browsers are updated. If okay, restart the Emsigner to check whether the error is resolved.

Solution for Mozilla Firefox

- Go to the options on the browser and click the Security tab on the left.

- Select the exceptions and enter the IP address https://127.0.0.1:1585

- Now save the changes and close the Emsigner and the whole browser.

- Now restart using the “run as admin” option.

- Login to the Good and Services Tax portal.

| GST Login | https://www.gst.gov.in |

| Gst Portal login | https://services.gst.gov.in/services/login |

| Cleartax gst login | https://accounts.cleartax.in/v2?product=gst&return_path=L24vc3NvP3JlZGlyZWN0X3VybD1MMjQ9&flow=login |

| Ewaybill gst login | https://ewaybillgst.gov.in/login.aspx |