How to Download Form 15G Online PDF and How to fill 15G Form Online. Download Form 15G for PF Withdrawal at https://www.incometaxindia.gov.in

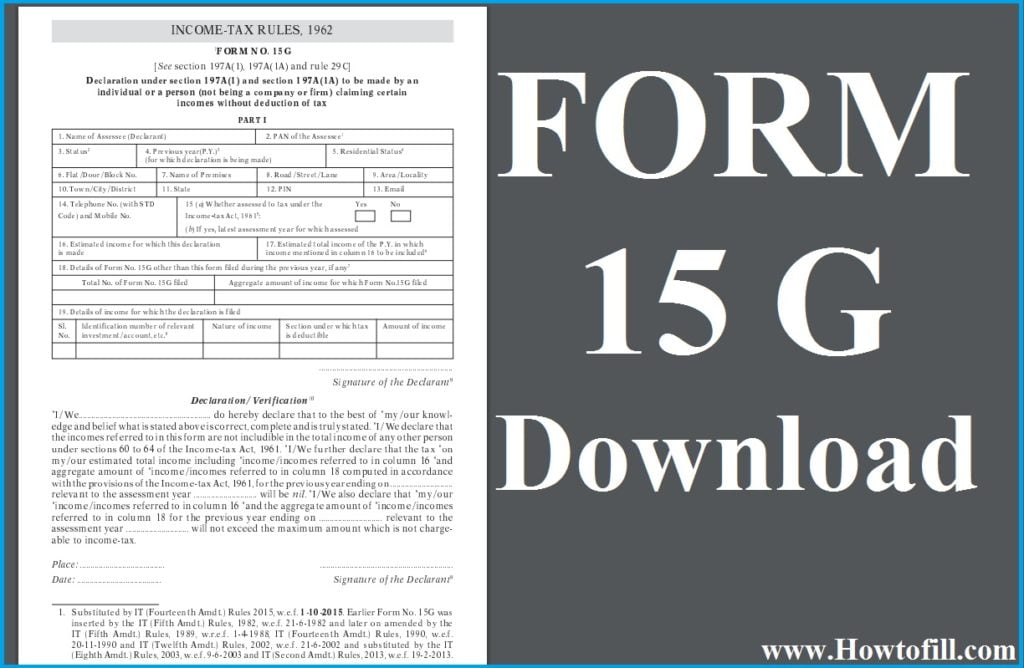

Form 15G

Form 15G is an official and legal declaration which only filled by bank fixed deposit cardholders. It applies to people less than 60 years and HUF. It ensures that no TDS (Tax deduction at the source) is taken or deducted from the interest income. Through an official rule from the income tax department, all banks in India should deduct Tax at the source for fixed deposits, recurring deposits, and other services. The deduction happens if the amount exceeds Rs. 10,000 in the financial year, however, the amount was increase to Rs. 40,000 in the interim budget of 2019-2020-2021-2022-2023-2024 2024-2025.

How to Download Form 15G Online?

The form is easily download from the official website https://www.incometaxindia.gov.in of all Indian significant Banks. You can also receive the form for the Income-tax department. On the website, page click on the option “click here to download form15G for free.” after filling, you can submit the form online using the bank website or income tax department page.

Form 15G sample

Form15G comes in a different format, according to the bank. The bank provides its 15 G though the original form is found on the income tax website portal.

Features on Form 15G

- Form 15G is a self-declaration form for individuals seeking non-deduction of the TDS on their income (annual income) if the amount is less than the given limit.

- The form has specified rules from the income tax department which go in line with section 197A of the income tax Act. 1961.

- The income tax has made several changes on the form since 2015 to ease the burden and cost for the deducting body and the account holder.

- There is a current form of 15-G and form 15H, which was introduce by CBDT.

- Form15G should be filled by individuals less than 60 years old. People above this age belong to the senior citizen category who should use the form 15H.

Eligibility Criteria for Submitting Form 15G

- An individual or a person but not a company or organization should fill the form.

- The applicant should be a resident of India for the applicable FY.

- People aged less than 60 years should fill the form.

- The tax liability calculated on total taxable income for FY is zero.

- If your total income for the financial year is less than the exemption limit.

How to Fill Form 15G?

The form is divided into two parts; the first belongs to individuals who need to claim no-deduction of TDS on some incomes. The second part is official only. On this part, fill the following details:

- Log in to your internet banking account, enter your user id and password.

- Select the online fixed deposit tab; a new page will open with fixed deposit details will show.

- Form the same page, select the option “generate form15G and form 15H” now click on the link to open the form.

- Fill all mandatory details to ensure the details are correct.

- Next, enter the bank branch details, which can be found on the bank’s website.

- Enter information about your investment then submits the form online.

Penalty for Submitting False Information on the Form 15G

Individuals providing wrong or false information to avoid TDS will have to face the harsh law set by the income tax department.

- Imprisonment for six months to 7 years if the declaration was to avoid TDS for more than Rs. 1 lakh.

- In other cases, the imprisonment is between 3 months to 3 years.

To avoid such a penalty, it is advisable to submit the declaration if you qualify for the tax department’s set rules.