Lalithaa Jewellery is a rare sophisticated, and unique Company in India. The Gold business was established in 1985 by Kiran Kumar in Chennai, Tamil Nadu and now operates in various states in India (Karnataka, Pondicherry, Andhra Pradesh, and Telangana). The Company offers quality Jewellery collections at affordable prices. The collections are pretty rare, making Lalithaa the best Jewellery dealer in the country.

Lalithaa Jewellery Gold Scheme

Lalithaa Gold Designs

The Lalithaa Company offers a variety of designs, including:

- Polki collections.

- Temple collections

- Antique Jewellery

- Kolkata Jewellery.

- Vigraha collections

- Kerala Jewellery

- Lightweight

- Rajkoot collections

- Ethnic collection

- Stone collections

- Avatar collections.

Lalitha Jewellery users can choose from a huge collection of bangles, earrings, coins, bracelets, jadai. Chains, etc. The products are exclusive and classy for every user. To purchase the Jewellery Lalitha offers excellent plans to help all users afford the products. The company offers several saving scheme which helps buyers purchase Jewellery without any strain.

Lalitha Jewellery scheme

The Lalitha Company sets several schemes to assist interested Jewellery users in purchasing quickly. One can select from the following schemes and learn the features and benefits to make a saving decision.

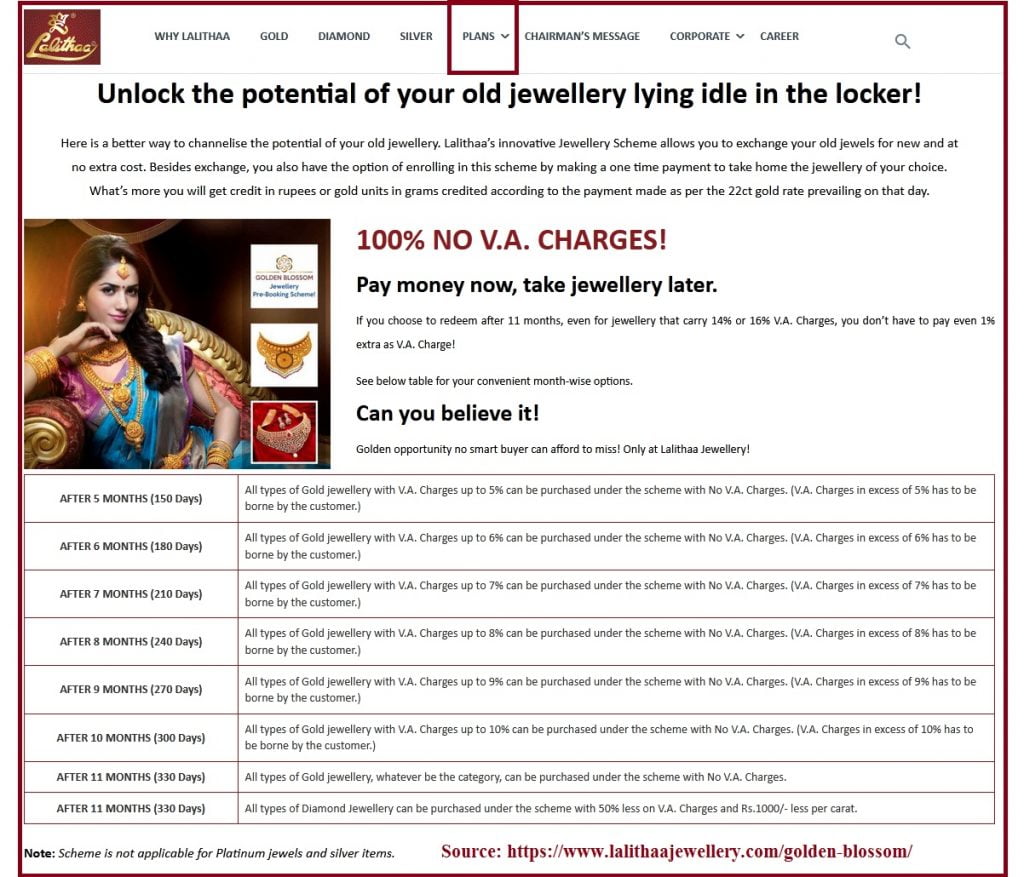

Golden Blossom

Eleven Monthly Scheme

1.Jewel Saving Plan

The Jewel scheme is also referred to Lalithaa free gold saving plan. The scheme is designed to help buyers contribute a monthly amount towards the Jewellery of choice.

Features of Jewel saving plan

- The Company allows for a minimum saving amount of Rs. 1,000 and multiples of Rs. 1000.

- The customer’s savings will be converted to gold based on prevailing rates.

- Lalithaa Company helps clients pay the 17th installment after maturing of gold. The buyer should be committed to pay the 16 monthly installments to get the benefit.

- Users can also purchase gold coins of the 916 purity once the maturity reaches.

- All installments should be paid at the agreed time. The buyers shouldn’t carry forward any installment amount.

- The Company accepts no advance installments.

- Lalithaa Company accepts cash payments, cheques, demand draft, pay orders directed to Lalithaa Thanga Maaligai.

Benefits of Jewel Saving plan

- The already purchased gold is credited directly to the user’s account at the prevailing rate per month. This helps the user avoid the increasing gold rates.

- The Company will credit the free gold after 30 days after the 16th installment.

- The gold doesn’t gain wastage charges for up to 14% of the selected Jewellery. However, when the weight exceeds the standard wastage charges. The customer should be the set charges.

- Customers don’t pay for making charges.

- The Lalithaa will cater for applicable value-added taxes.

Things to note

- The saving plan is only valid for 24 months from the date of the last installment.

- Lalithaa Company doesn’t do cash refunds, and maturity dates cannot be advanced.

- Users cannot merge the scheme with different offers.

- When the Jewellery selected exceeds the weight acquired. The customer needs to pay for the difference together with the wastage charge of the excess weight.

- Customers can purchase other Jewellery under different sections using the plan. However, they must pay for the wastage and making charges.

- If the customer defaults, they must pay for wastage, making charges, and VAT to get the Jewellery.

- Note the customer signature and registration should match the signature at maturity.

- Ensure to update the passbook and keep payment records for reference.

- The company offers a duplicate passbook at Rs. 50 together with affidavit.

- Clients should check the passbook regularly to ensure proper recording.

- The Chennai jurisdiction handles any disputes.

2.Gold Plus Saving Scheme

The Gold plus saving scheme is a 12-month saving scheme developed to help customers gain the required amount to buy their preferred Jewellery.

Features of Gold plus saving scheme

- Applicants can benefit from gold, gold coins, and silver.

- The scheme only goes for 12 months.

- The customer has the choice to extend the period after 12 months.

- Once the last installment is paid, the user is allowed to buy 916 hallmark gold Jewellery, silver, and gold coins at the end of next month.

- After the last installment, the plan is valid for 24 months.

Benefits of Gold plus saving scheme

Things to know

- The customer should use the same signature during registration and maturity time.

- Defaulting from the payment requires the customer to pay wastage charges, marking, and VAT before purchasing the Jewellery.

- Buyers opting for other products outside the saving scheme must pay for wastage and making charges.

- The scheme covers special Jewellery, CZ Jewellery, diamond, platinum, CZ stones, ruby stones, and emerald stones.

- Any payment done using post should be recorded immediately to avoid discrepancies.

- In case the user loss their passbook, they should pay Rs. 50 together with affidavit.

- Any dispute is resolved at Chennai jurisdiction.

- The users should combine the scheme with other offers.

3.The Zero % gold Jewellery Purchase Plan

The plan also helps users save to acquire Jewellery in the future. The plan doesn’t charge any wastage charges.

Features

- The plan offers a minimum of 12 months.

- However, after 12 months, the client can extend to preferred months.

- The zero % gold Jewellery purchase plan is valid for 24 months after the last installment date.

- The user can purchase 916 hallmarks gold Jewellery, silver, and gold coins.

Benefits

4.Lalithaa Golden Sparrow

Lalithaa Golden sparrow is a plan going for 11 months. The customer benefits from zero wastage and VAT charges. The customer can select the preferred Jewellery in the 12th month.

Features

- The plan offers customer membership cards and passbooks during registration.

- The scheme installments are: Rs.500, Rs. 1000, Rs. 2000, Rs. 3000, Rs. 5,000, Rs.10,000 and Rs. 15,000.

- The scheme validity is 11 months, after which the user can purchase any Jewellery in the 12th month.

- In case the selection has special stones, diamonds, ruby, emeralds, zircons, and more. The user should pay the stone charges.

- The Lalithaa Company will pay 1% VAT.

- After purchasing the Jewellery, the user should refund the membership card.

- The Company allows another person to collect the products. However, they must present an authorization letter and ID proof.

- Note the person who signed the application form should also sign the invoice.

Things to note

- Customers cannot pay installments in advance.

- It’s a non-transferable scheme.

- Suppose the customer doesn’t redeem the amount within the set period. The company will refund the funds through cheque. Note cash refunds are not applicable. The Company won’t offer any benefits to the user.

- The disputes are settled at the Chennai jurisdiction.

FAQs

Who is eligible for the Lalithaa schemes?

All schemes are open to Indian residents or any person who wishes to purchase Jewellery.