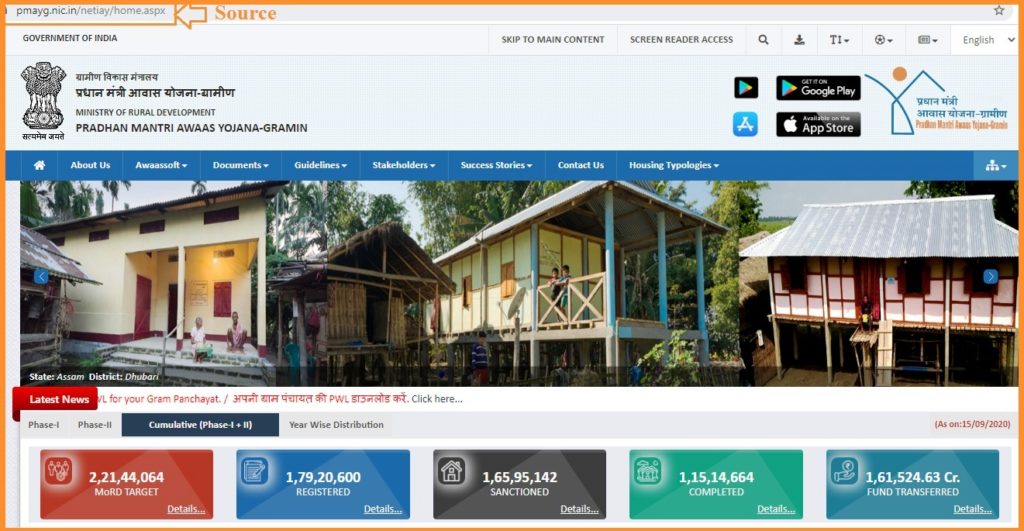

The Pradhan Mantri Awaas Yojana Gramin (PMAYG) scheme 2024 at https://pmayg.nic.in/netiay/mapview_home/home.html

PMAYG

In conjunction with the state government, the central government has raised a plan which should be fulfilled by the year 2024. The program involves all Indian citizens who have poor housing or no housing at all. The government implemented and launched a scheme which would handle the project and provide low-cost and durable housing for all. The Pradhan Mantri Awaas Yojana – Gramin ( PMAY-G ) is the official scheme launched by the central government to overlook the housing project for all eligible Indian citizens.

PMAY-G

AIM Of PRADHAN MANTRI AWAAS YOJANA-GRAMIN (PMAY-G) The initial and final aim for the PMAY-G scheme is to provide proper housing for all. It should provide a Pucca house which will have some of the basic facilities. The scheme is to help people or families who don’t own a house or live in Kutcha houses. Kutcha are houses with bad conditions and not fit to live in; the government has issued the size to build, which should be 25sq. mt. Previously the measurements were 20sq.mt. Eligible applicants can check details from the official website link www.pmayg.nic.in

Pradhan Mantri Gramin Awaas Yojana

PMAY-G details

| Scheme website link | https://www.pmayg.nic.in/netiay/home.aspx |

| Toll-free numbers | 1800-11-6446 1800-11-8111 |

| Complaints and suggestions | Support-pmayg@gov.in/ or helpdesk-pfms@gov.in |

| Beneficiary registration guide | Select download manual from the link |

| State-wise contact person details | PMAY-G implementation |

| PMAY-G App | Android and IOs |

PMAY-G Subsidy Scheme

The scheme offers beneficiary loans for up to Rs. 70,000 from different financial institutions.

- The loans will have an interest subsidy of 3% and a maximum principal of the amount of Rs.2 lakhs.

- The maximum subsidy amount availed is Rs. 38,359 for the EMI payable.

Features of PMAY-G scheme

- The government uses a different parameter to find a deserving beneficiary, they use social-economic and caste census instead of BPL List.

- The housing project is a combined effort of the central government and state government to build houses for beneficiaries in the hilly and plain areas.

- The Union territories will also benefit from the scheme, where the UT of Ladakh will receive full financial assistance. However, the Union territory of Jammu and Kashmir will share the responsibility at a ratio of 90:10 from the central government and state government.

- For the construction of toilets, the beneficiaries of PMAY-G will receive the financial assistance of RS. 12,000 from the Swachh Bharat Mission-Gramin.

- Beneficiaries will receive payments under the Pradhan Mantri Awaas Yojana—Gramin scheme. The finances are deposited to the post office or bank account linked to the Aadhaar card.

Eligibility Criteria of PMAYG

- Citizens without their own house or living in Kutcha houses.

- Families without any male adult age 19 to 59 years.

- Homes without a literate adult within the age of 25 years.

- If the family has a disabled member.

- IN the family has no bodily-abled member.

- If the household has no land and earns a living by working as casual laborers.

- Families from the SC/ST and other minority categories.

- If the family has no motorized vehicle, agriculture-related equipment, or fishing boat.

- Applicants with Kisan credit card with a limit of Rs. 50,000.

- If the family has no government employee or person earning Rs. 10,000 or more.

- Individuals who are not eligible for any professional tax, including the income tax.

Required Documents for PMAY-G

The applicant should have the following details before applying for the scheme.

- Your Aadhaar number.

- Consent documents should use the Aadhaar on behalf of the beneficiary.

- The applicant should have the Swachh Bharat Mission SBM number.

- Correct bank account details.

How to Apply, Register, and Add a PMAY-G beneficiary?

The PMAY-G registration is divided into four sections:

- Personal details

- Information about the bank account.

- Convergence details.

- Official details from the concerned office.

PMAYG Registration Process

- Go to the official PMAY-G website page link https://www.pmayg.nic.in/netiay/home.aspx

- On the homepage, go to the personal details tab, enter all the personal information required:

- Gender

- Mobile number

- Aadhaar number.

- Next, upload the consent form required to use the Aadhaar number.

- Now click on the search button and find the beneficiary name, PMAY ID, and priority.

- Proceed and click on the tab select to register, the system will automatically generate and display on the screen.

- Next, enter the remaining beneficiary details such as ownership type, Aadhaar number, and relation.

- Again upload the consent from the required to use Aadhar number on behalf of the beneficiary.

Account details

- In the next section, the applicant should add beneficiary account details on the required space provided.

- Enter the beneficiary’s name, bank account number, etc.

- On the page, the beneficiary can click on the “yes” button if they need a loan, enter the loan amount, and proceed.

- Next, enter the MGNREGA job card number and the Swachh Baharat Mission SBM number of the beneficiary then submit.

- The last section should be left for the office to fill.

How can I check my name on the PMAY-G 2024-25 beneficiary list?

The applicant can check the name using the registration number or other details as follows:

- Go to the official website and click on the option “stakeholder.”

- Next, select the option IAY/PMAYG beneficiary form and enter the registration number.

- Now click the search button to access the name.

- For applicants without the registration number.

- Go to the advance search tab, and the system will open a new page.

- Enter all required details then select the option “search.

Frequently asked questions

Is the PMAY-G scheme available for existing home loan borrowers?

The existing home loan borrower eligible for the scheme can avail of their details at the respective bank. The bank has the mandate to review the request then send it to the National housing bank NHB. If they qualify, the NHB will disburse the subsidy amount to the applicant’s bank account.