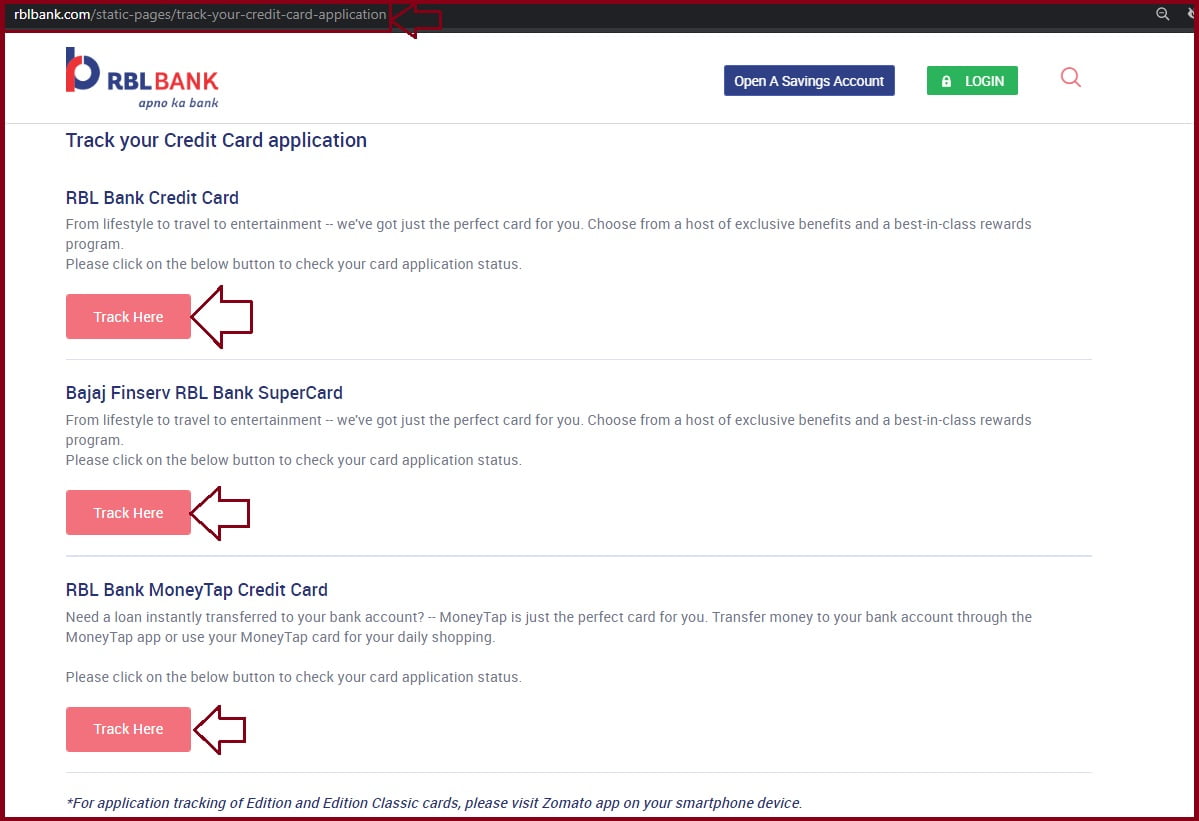

Track Your RBL Bank Credit Card Application Status 2025 Online for free at https://rblbank.com/static-pages/track-your-credit-card-application (or) https://www.rblbank.com/track-app-status

RBL Credit Card Status

Credit cards provide an array of benefits based on the user’s needs and priorities. The cardholder’s lifestyle determines the choice of the credit card to settle for. It’s a great way to go cashless and clear bills easily. The RBL bank India is one of the growing and popular banks in the country. It started as a single state bank and expanded its services all over India.

RBL bank provides different banking and financial services through online and offline platforms. The bank provides credit card services based on the category and preference of the applicant. RBL customers can apply through an online portal or visit the bank branches near them for application.

Rblbank.com/static-pages/track-your-credit-card-application

https://www.rblbank.com/track-app-status

There are different RBL credit card categories as follows:

- Shopping card

The user gets rewards, offers, and discounts from online and offline shopping.

- Cashback card

The card help applicant to save money on every purchase they make and through cashback points.

- Travelcard

You have the privilege of accessing lounges at the airports and discounts on tickets and hotel bookings.

- Lifetime free card

The applicant benefits from free credit cards, which have no annual fee.

- Business card

The help helps the user to manage their business with advanced credit.

- Lifestyle card

The card provides rewards on basic utilities and discounts.

- Entertainment card

Eligibility Criteria

To access the RBL credit card, you need to fulfill the bank’s eligibility criteria. Every card is limited to certain factors, such as income. The applicant needs to present their income information, whether employed or self-employed.

- Age: the applicant should be age 21-65 years, add-on cardholders should be 18 years.

- Income: the income factor is different based on the type of credit card. The bank will request proof documents.

- The applicant should be an Indian resident.

Required documents

- Address proof

- Identity proof details

- Income proof

- PAN card

- Passport size photo.

How to Apply for RBL Credit Card

- Open the RBL website and go to the credit card page. https://www.rblbank.com

- On the homepage, enter your detail and contact information.

- Upload your KYC documents on the portal.

- The bank will verify the details, and an RBL bank representative will contact you. The bank official will guide you in the next application process.

- You can also visit the bank branch for the application process.

RBL Credit Card Application Process for Existing Customers

- Go to the RBL official website and proceed to the credit card page.

- Enter your net banking customer id and mobile number.

- You can proceed with the online application or visit the nearest RBL bank branch.

RBL Credit Card Application Status

After the application process, the bank issues an application id or reference number. You can track your application status using the number in the following steps.

How to Track RBL Credit Card Application Status Online

- Go to the RBL website page.

- On the menu, click the option “track your online application status.” https://www.rblbank.com/static-pages/track-your-credit-card-application

- Next, enter the RBL credit card application id, including the #.

- Proceed and enter the registered mobile number.

- Finally, click the submit button.

- The system will verify the details and, if correct. The application status will show on your screen.

The portal will provide different results according to the stage the application process has reached.

- In progress: the RBL bank verifies and reviews the credit card application and will proceed further after the verification.

- On hold: if the status shows “on hold,” this means the bank went through your application. However, they require more details to proceed. The bank representative will call or SMS to enquire more about the details you provided.

- Rejected: this means your application is canceled or disapproved by the bank. You should call or visit the bank to get reasons for the rejection.

- No records found: the status shows the applicant provided wrong details. You should re-apply or visit h bank for offline application.

- Dispatched: the status implies the card was approved and already sent. The bank will provide all dispatch details.

FAQs

How can I check my application status without the application ID?

Applicants can use alternative methods such as PAN/mobile number to get the credit card application status.

- Open the RBL official website page and proceed to the credit card tab.

- Next, enter your registered mobile number.

- The system will send an OTP to the number. Use the OTP to verify the details you provided.

- Click submit button.

- The portal will provide the application status instantly.

How Can I Check My Application Status Offline?

Users who don’t prefer online methods can visit the RBL bank branch near them. Here they will get help from bank officials. You must provide your application ID or mobile number to get the status check. They can also call customer care through the numbers: 022-62327777 or 022-71190900.

Check RBL Bank Credit Card Application Status 2025 Online

Direct link : https://www.rblbank.com/static-pages/track-your-credit-card-application (or) https://www.rblbank.com/track-app-status