LIC Credit Card Application Status 2025: eligibility, एलआईसी क्रेडिट कार्ड application, and LIC Credit Card Status & How to apply LIC Credit Card Registration 2025 process at https://www.liccards.co.in

LIC Credit Card Status

The LIC Credit cards are popular transaction documents that offer short-term loans to uses to fulfill their purchasing need. The user can pay for bills or enjoy various services using a credit card based on the type. Different benefits and point rewards distinguish the cards. LIC is a famous Indian insurance Company managed by the Ministry of Finance, Government of India. The Company offer policyholders various credit card services.

The card helps in policy payments and other services. The LIC credit card is merged with Axis Bank and offers the following LIC credit cards.

- LIC Gold credit card (regular users)

- The LIC platinum credit card (shopping and rewards)

- LIC Titanium credit card (traveling and hotel booking)

- LIC signature credit card (premium services)

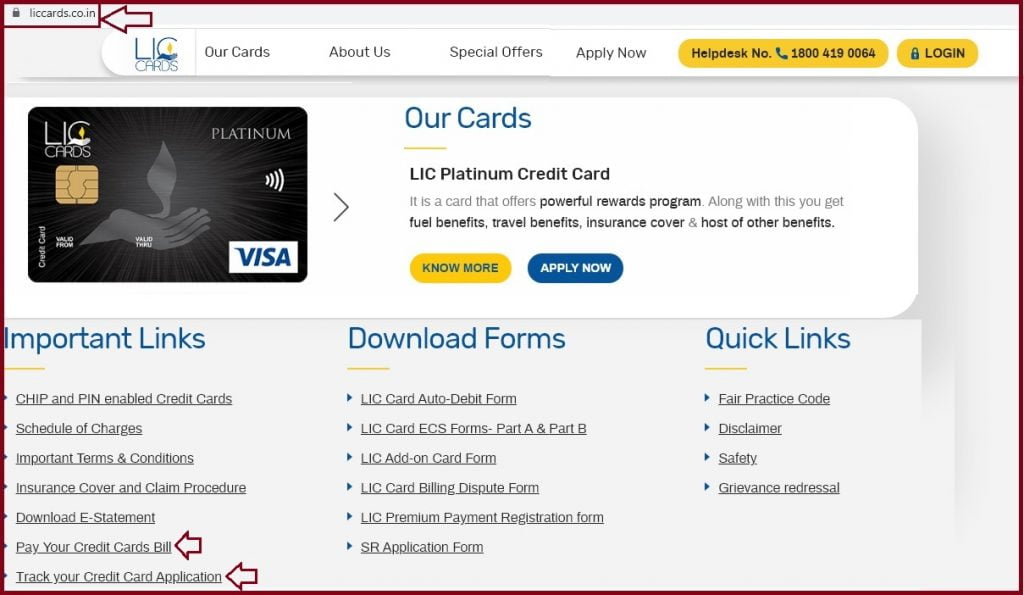

Licccards.co.in

How to Apply for LIC Credit Card

- Open the LIC Credit card official website page. https://www.liccards.co.in/

- The page will display different credit cards that offer various benefits.

- Select the apply button to receive the application form on the screen.

- Enter the required details and upload the documents such as photos and click submit button.

The policyholders can also call the customer support number to apply for a LIC credit card. The Company offers a toll-free number as follows 1800-2331-100. One can also visit the LIC branch offices situated in the country to manually apply for a credit card.

Required Documents

- Identity proof documents

- PAN card

- Aadhaar card

- DL

- Passport

- Person of India origin card

- Job card provided by NREGA.

- Address proof documents

- Utility bill

- Job card issued by NREGA

- Property registration document.

- Aadhaar card

- DL

- Passport

- Income documents

- Salary slip documents

- Bank statement

- Latest from 16.

LIC Credit Card Application Status 2025

How to Check LIC Credit Card 2025 Application Status:

Once a LIC policyholder applies for a credit card, the bank sends a confirmation message followed by a reference number or application number. The numbers help users to check the application status and determine whether the process is complete.

LIC CC Application Status Through Online Process

- Open the LIC Cards website page via the link https://www.liccards.co.in

- On the menu, click the option “credit cards.”

- Next, enter the application number or reference number to proceed.

- The system will display the application status on the screen.

Checking LIC CC Application Status Through Mobile Number

- Go to the LIC Credit cards portal page.

- Next, click the “credit cards” option to continue.

- Key in the registered mobile number and submit the details.

- The page will generate the status based on the number given.

LIC Credit Card Application Status Check Through Customer Care

LIC support number is always available; users can call the number 18004190064 to confirm the application status details. Results on Lic Credit Card application status

In progress

The statement means the bank is still processing the credit card.

On hold

The bank can hold the process due to incomplete details or if they require more verification details. The bank officer will contact you in case they need any information.

Approved

Once the process verification process is done, the bank will approve your credit card.In few days, the bank will send your card to the address given during the application.

Dispatched

After approval, the next step is the dispatch of the credit card user’s mentioned address. The process takes 2 to 3 working days. The bank will send a message specifying the dispatch address.

Disapproved

The bank can also disapprove your credit card application request due to various reasons. You can visit the bank for a better understanding. However, the bank always states a reason for rejecting the proposal.

No records found

In case there are mistakes in your details, the bank will display a no record found status. You can repeat the process or enquire from the bank.

FAQ’s

Which address is suitable when applying for a LIC credit card application?

It’s advisable to enter your permanent or work address for easy access. The address directs the bank on dispatching the credit card. A work address is convenient since you will receive the card at your workplace.

Can I apply for multiple LIC credit cards?

The user can consult the LIC support team whether they qualify for multiple credit cards. One must have good credit history before applying for more cards.

LIC Credit cards Help line Number

Toll Free: 18004190064

Lic credit card bill payment portal

Direct link: https://www.billdesk.com/pgidsk/pgmerc/liccard/lic_card.jsp