The IDBI Bank credit card statement 2024: IDBI credit card application, eligibility criteria, and IDBI creditcard statement PDF Download online at https://idbibank.in

IDBI Bank Credit Card

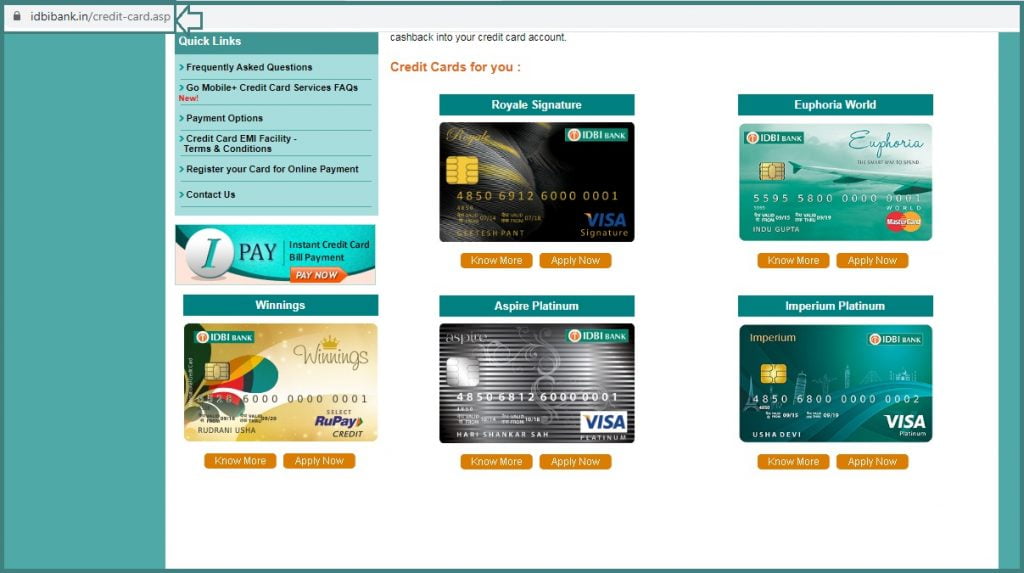

The IDBI bank understands the spending habits of all their registered clients. And thus introduces credit cards that suit their needs. IDBI offers a wide range of credit card categories. Each attached with different benefits. Customers can select the card that suits their priority. The cards help save money through offers and rewards based on the category.

IDBI Credit Card Categories

- Travelcard

- Shopping card

- Reward card

- Lifetime free card

- Business card

- Lifestyle card

- Business card

- Entertainment card

- Cashback card

Eligibility Criteria

To access the credit card benefits, the user must fulfill the set criteria by theIDBI bank.

- Age

The bank allows applicants in the age limit of 21-65 years, and the add-ons cardholder should be 18 years. Anyone below or past the said age is not eligible for credit cards.

- Income

To request the IDBI bank card, the applicant must have a regular income. However, the income criteria will differ according to the credit card preference. The customer should provide income proof documents when applying for the credit card.

- Nationality

The applicant should be a resident of India.

Idbibank.in/credit-card.aspx

How to Apply IDBI Credit Card for New Customers

- Open the IDBI bank website page to access the credit card page.

- https://www.idbibank.in/credit-card.aspx

- On the IDBI page, enter your personal and contact details.

- Enter or upload your KYC documents on the page.

- The system will verify the details, and a bank representative will contact you.

- The representative will guide you through the next steps.

- You will receive an application ID or reference number.

- Applicants can also visit the bank for credit card applications.

Required Documents

- Address proof documents such as passport, DL, voter id, and more.

- Identity proof documents

- Income proof

- PAN card

- Recent passport size photo.

IDBI Bank Credit Card Statement

How to check IDBI Credit Card Statement

The IDBI credit cardholders can check their card statements through online platforms. The statement will contain details like address, account number, registered mobile number, and name. The card statement will display the expenses and total balance available on your IDBI credit card.

How to Check IDBI Credit Card Statement Using IDBI Net Banking

- Visit the IDBI website page and log in to the IDBI credit card net banking account page.

- https://inet.idbibank.co.in

- On the menu, click the option “credit cards.”

- Next, click the “credit card statement” option.

- Select the time (month or year) which you want to view the statement.

- The system will display the statement details on your screen.

IDBI Bank Credit Card Statement Check via IDBI Mobile Banking

- On your smartphone, download the IDBI mPassbook app.

- After the installation, enter your mobile number and customer ID.

- Enter the OTP number sent to your mobile number to verify the details.

- Select the option “proceed,” the system will request you to set your PIN.

- The PIN helps you access the app.

- Proceed to tab “credit cards” followed by the option “statement.”

- Choose the time frame in which you require the statement.

- The system will produce the statement and display it on your screen.

FAQs

Can I check my e-statement through offline methods?

Yes, the IDBI bank has customer care toll-free numbers 022-40426013 or 18004257600. You can also give a missed call to the number 18008431133. The call will give few rings and automatically disconnect. The bank will send a mini statement through the SMS method.

IDBI Credit Card Customer care number

1800-209-4324 & +9122-67719100 (chargeable)